Executive summary

Strategic imperative:

In a hyper-competitive insurance landscape, adopting AI software for policy checking is no longer optional but a requirement for maintaining operational efficiency and client service standards.The resource gap:

Distributors are under mounting pressure to process higher policy volumes with fewer resources while facing increased liability from manual errors.The custom build trap:

Custom-built AI software often promises perfect alignment but frequently results in 12–18-month delays and high "hidden" maintenance costs.Production-ready advantage:

Established solutions offer a "virtuous cycle" of stability, drawing from collective industry wisdom and real-world testing across diverse carrier formats.Accuracy via hybrid intelligence:

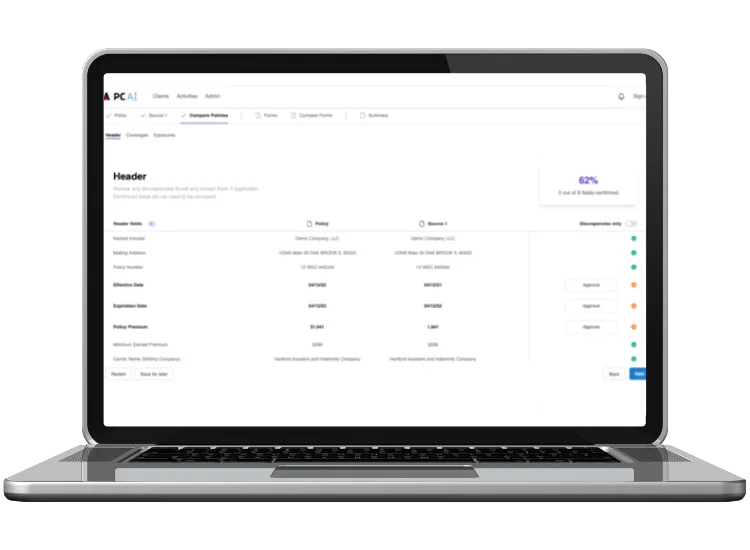

To mitigate E&O exposure, the most effective systems utilize a "human-in-the-loop" approach rather than relying solely on fallible full automation.

Why AI software for policy checking is imperative for agencies

Policy checking stands at a critical intersection of risk management, operational efficiency, and client service. When performed effectively, it safeguards organizations from potential E&O exposure while ensuring clients receive accurate documentation of their coverage. When performed poorly or worse, inconsistently, it creates significant liability exposure and can damage client relationships.

As insurance organizations evaluate AI software solutions for policy checking, they are often presented with a fundamental choice: adopt an established, production-ready solution that serves customers, or pursue a custom-built alternative that promises perfect alignment with their specific processes. This decision carries far-reaching implications for implementation timelines, operational stability, long-term costs, and organizational success.

The stakes are particularly high for insurance distributors, where policy checking directly impacts compliance, client relationships, and financial outcomes. Making the right choice requires looking beyond initial promises to understand the complete picture of what each approach truly delivers.

The allure of custom software

Custom-built AI software solutions hold an undeniable appeal. Vendors of these solutions often paint an enticing picture of software perfectly molded to an organization’s unique processes and workflows. For distribution leaders, the promise of having technology that works exactly the way their organization does feels like the ideal scenario.

This allure is particularly strong in policy checking, where each organization has developed specific protocols and practices over time. The promise of software that perfectly replicates these existing processes, while adding automation, can seem like the perfect solution. Custom development vendors emphasize their willingness to build exactly what you want, rather than requiring adaptation to a standardized approach.

Additionally, these solutions may appear to offer competitive technology that rivals cannot access because it is built exclusively for your organization. Executive teams may find this exclusivity particularly appealing as they seek differentiation in a competitive market.

When presented with slick demonstrations of what custom software could do specifically for your organization, it is easy to envision a perfect solution that addresses every nuance of your operations without compromise.

The hidden realities of custom development

Behind the compelling promises of custom development lie realities that often become apparent only after contracts are signed. Most significant is the challenge of timeline accuracy. While vendors may initially project implementation dates measured in weeks or months, custom development frequently extends far beyond these estimates. It is common for organizations to discover that the solutions promised within six months may take 12-18 months or longer to fully implement.

This timeline uncertainty creates significant opportunity cost as organizations remain tethered to inefficient manual processes while awaiting their custom solution. For insurance distributors processing thousands of policies annually, each month of delay represents continued exposure to errors, inefficiency, and competitive disadvantage.

Even once implemented, custom-built AI software introduces a perpetual maintenance burden. Since the code is unique to a single client, every industry change, regulatory update, or enhancement must be custom-coded specifically for that environment. Without a broader client base to distribute development costs, these ongoing changes can quickly become expensive and resource intensive.

Reliability presents another critical concern. While established solutions benefit from extensive real-world testing across diverse scenarios, custom solutions often encounter unexpected issues when faced with the full variety of documents and scenarios present in live operations. The result can be frustrating downtime, manual workarounds, and disruption to critical workflows.

For policy checking specifically, these reliability issues can have profound consequences. When checking systems fail, organizations face difficult choices between delaying client deliverables or proceeding without proper verification—both options carrying significant risk.

Most concerning is the resource drain that custom development places on both the vendor and client. As development complexities inevitably arise, vendors must allocate limited programming resources across competing client priorities. Meanwhile, client staff must devote considerable time to requirements definition, testing, and troubleshooting—time that could otherwise be spent on revenue-generating activities.

The production-ready advantage

“Production-ready” represents more than marketing terminology, it signals a fundamental difference in approach to solving insurance AI software challenges. A truly production-ready solution has undergone extensive testing and refinement through real-world implementation across diverse client environments. It has encountered and addressed countless edge cases, document variations, and workflow scenarios.

Solutions built on extensive industry experience incorporate the best practices developed through serving numerous clients. Rather than reflecting a single organization’s approach, they embody collective wisdom about effective policy checking processes. This breadth of experience often results in capabilities that individual organizations might not even know how to request, but that deliver significant value.

Standardized implementation methodologies dramatically accelerate time-to-value. While custom solutions require building from the ground up for each client, production-ready solutions follow established implementation playbooks with predictable timelines and milestones. Organizations can confidently plan around these timelines and begin realizing benefits in weeks rather than months or years.

For mission-critical operations like policy checking, reliability becomes paramount. Production-ready solutions benefit from continuous improvement based on feedback from a diverse client base. Issues encountered by one client led to improvements that benefit all users, creating a virtuous cycle of enhanced stability. Mature solutions typically offer defined uptime guarantees backed by monitoring, redundancy, and proven support processes.

Most valuable is the advantage of real-world testing across diverse scenarios. Every policy format, endorsement type, and carrier variation encountered by any client helps strengthen the solution for all users. This collective experience creates robust handling of exceptions and edge cases that would take years for a custom solution to develop.

Key considerations when evaluating policy checking solutions

When evaluating AI software for policy checking, implementation timelines deserve scrutiny. Rather than accepting projected dates at face value, insurance leaders should request detailed implementation plans with specific milestones. Asking prospective vendors about their implementation history, including examples of timelines that were not met and how those situations were managed, can provide valuable insight into what to expect.

Reference checking takes on heightened importance when comparing established versus custom approaches. Speak with references who are using the specific solution being proposed, not a different product from the same vendor. For custom solutions, ask to speak with clients at various implementation stages, including those still in development. Inquire specifically about timeline accuracy, support responsiveness, and system reliability.

Total cost of ownership extends far beyond initial pricing. Consider implementation costs (including internal staff time), ongoing maintenance requirements, system reliability (and associated downtime costs), and the opportunity cost of delayed implementation. Custom solutions often carry significant hidden costs through extended timelines, unexpected development challenges, and ongoing maintenance needs.

System stability and uptime guarantee provide critical insight into real-world performance. Ask vendors about their up-time statistics, monitoring processes, and remediation procedures. Request details about recent outages, their causes, and how they were resolved. This information reveals both the solution’s reliability and the vendor’s transparency about inevitable challenges.

Understanding the quality assurance approach is particularly important for policy checking. There are solution providers that promise fully automated processing without human oversight, while others incorporate expert review at critical points (the “human-in-the-loop” approach). The fully automated approach may seem more efficient but often sacrifices accuracy and increases E&O exposure, particularly for complex commercial policies.

Finding the right balance: Customization vs. configuration

Understanding the distinction between customization and configuration proves crucial when evaluating policy checking solutions. Customization involves writing custom code specific to a single client’s needs, creating unique functionality that must be separately maintained and updated. Configuration, by contrast, involves tailoring a standard solution through settings, preferences, and options already built into the platform.

Established solutions typically offer extensive configuration options without requiring custom code. These might include adjustable workflows, document templates, reporting parameters, integration options, and user permissions. The key advantage is that these configurations work within a proven, stable framework rather than requiring unique code that may introduce instability.

Standardized solutions incorporate industry best practices developed through serving numerous clients. Rather than reflecting a single organization’s idiosyncrasies, they embody collective wisdom about effective policy checking processes. This often results in workflows and features that outperform an organization’s existing processes while still adapting to specific needs.

When evaluating solution flexibility, ask specific questions about how the system manages unique requirements. Can it accommodate your specific document formats? How are carrier-specific forms managed? What happens when new form types emerge? The most effective solutions offer both current flexibility and adaptive capabilities to address future changes.

Conclusion

The technology decisions insurance distributors make today will shape their operational capabilities, competitive position, and growth potential for years to come. While custom-built solutions may appear perfectly aligned with current processes, they typically introduce significant risks through extended implementation timelines, reliability challenges, and ongoing maintenance requirements.

Production-ready solutions offer compelling advantages through faster implementation, proven reliability, and continuous improvement based on collective client experience. These advantages prove particularly valuable for policy checking, where accuracy and consistency directly impact E&O exposure and client relationships.

The most successful implementations occur when organizations select established solutions with robust configuration options, allowing them to benefit from industry’s best practices while still adapting to their specific needs. This approach delivers the best of both worlds: customization without custom code, stability without stagnation, and innovation without uncertainty.

As insurance distributors navigate an increasingly complex and competitive landscape, the ability to implement effective technology solutions quickly becomes a strategic advantage. By choosing established, production-ready policy checking solutions, organizations can accelerate their digital transformation journeys while avoiding the pitfalls of custom development.

Is technology holding back your agency’s growth?

Patra’s AI platform adapts to your workflows without the burden of custom code, helping your agency stay competitive for the decade ahead.

Recap: Navigating your technology transition

Selecting the right AI software is a high-stakes decision that dictates whether an insurance agency will experience rapid digital transformation or fall into the “custom build trap” of 12–18-month delays and high maintenance costs. While the allure of a bespoke solution is strong, production-ready solutions offer a superior “virtuous cycle” of stability, drawing on collective industry wisdom and real-world testing across diverse carrier formats. By prioritizing a “human-in-the-loop” approach and focusing on configurable platforms rather than custom-coded ones, distributors can mitigate E&O exposure and ensure long-term operational excellence. The goal is to implement a solution that balances immediate time-to-value with the flexibility to adapt as the insurance landscape continues to evolve.

Frequently asked questions

While custom software promises perfect alignment with your specific processes, the reality is that established policy checking solutions already incorporates industry best practices and offers configuration options to adapt to your needs. Custom development often leads to extended timelines, higher costs, and ongoing maintenance challenges that can outweigh the perceived benefits of absolute customization.

Request specific, written commitments to implementation milestones. Ask to speak with recent implementation references, not just long-term clients. Inquire about the vendor’s implementation record and their capacity to support multiple concurrent implementations. A transparent vendor will share both their successes and how they have managed challenges.

Beyond the initial price, consider implementation time (and associated opportunity cost), ongoing maintenance requirements, reliability factors (downtime cost), staff training, and support costs. Custom solutions typically incur significant “hidden” costs through extended timelines, code maintenance, and system instability that are not reflected in initial quotes.

Quality production-ready solutions offer substantial configuration options without custom coding. These include workflow adjustments, report customization, branding options, and integration capabilities. The key advantage is that these configurations work within a proven, stable framework rather than requiring unique code that may introduce instability.

Established solutions typically follow a regular release schedule, incorporating industry changes and new features based on client feedback. This provides a predictable path without the uncertainty of custom development timelines. Additionally, configuration options allow for adjustments as your needs evolve.

Next steps for insurance distributors

When evaluating AI insurance software options, these concrete steps can help ensure a successful selection process:

Document current process and pain points

Before engaging with vendors, thoroughly document your current policy checking process, including specific pain points, bottlenecks, and error sources. This clarity helps evaluate how different solutions might address your most pressing needs.Define success metrics

Establish specific, measurable criteria for what success looks like with a new solution. These might include processing time reduction, error rate improvement, staff time reallocation, or client service enhancements. These metrics provide an objective framework for evaluation.Request demonstrations with your documents

Ask vendors to demonstrate their solutions using your actual policy documents rather than carefully prepared samples. This provides insight into how the system manages your specific document types and complexity.Develop a detailed evaluation checklist

Create a comprehensive checklist covering implementation requirements, technical capabilities, configuration options, support services, and security features. Use this checklist to ensure consistent evaluation across vendors.Speak with multiple references

Connect with multiple client references for each vendor, ideally organizations like yours in size and requirements. Ask specific questions about implementation experience, timeline accuracy, and ongoing support quality.Calculate complete ROI

Develop a comprehensive ROI analysis that includes all costs (implementation, subscription/license, training, maintenance) against expected benefits (time savings, error reduction, E&O exposure mitigation, growth enablement).Establish a realistic timeline

Create a realistic implementation timeline that accounts for your organization's readiness, resource availability, and critical business cycles. Build in contingency for unexpected challenges. By following these steps, insurance distributors can navigate the technology selection process with confidence, choosing solutions that deliver bona fide business value with minimal implementation risk.

About Patra

Patra is a leading provider of AI-powered software solutions and technology-enabled insurance outsourcing services. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance groups through its PatraOne platform. With a global team of over 6,500 process executives, Patra helps agencies, brokers, wholesalers, MGAs/MGUs, and carriers achieve profitable growth and organizational value.