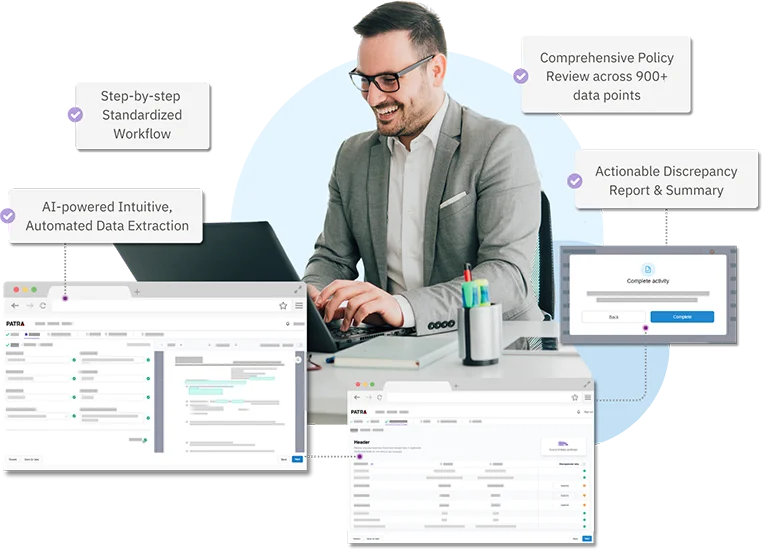

Patra's AI highlights

Patra AI-powered insurance solutions

Built on 20 years of insurance BPO strategy expertise, Patra’s proprietary, patent-pending AI technologies optimize the entire policy life cycle for every insurance distribution channel.

Our technology-enabled services improve speed, accuracy, and efficiency while unlocking new business insights to enhance decision-making.

Patra’s flexible document automation platform, Patra AI, empowers distributors to compete and win in today’s dynamic insurance market.

Insurance BPO transforming your operations

As an industry leader in providing insurance outsourcing strategies, Patra’s solutions and services support, elevate, and grow insurance organizations’ book of business through every step of the insurance policy lifecycle.

Employee benefits services

Flexible, scalable solutions to support the entire Employee Benefits process.

Virtual staffing assistance

Full time VAs to support back-office tasks and help eliminate backlogs.

Small business management

Licensed account managers to manage and grow your books of small business from A to Z.

Contact center management

The ultimate insurance contact center solution with email, voice, chat, text, and mail.

Print and mail services

Full-service print, mail and virtual mail solutions with a dedicated mailing department.

Leading insurance organizations trust Patra

business process outsourcing services.

issued

processed

saved

checked

customized

Numbers are calculated over the past 12 months

Schedule a call with our team of insurance experts.

Let's discover together what's blocking your organizational growth, and how to unblock it!

A proven approach to optimizing insurance operations

The proven leader in insurance process improvement

Technology & Automation

Accelerate business transformation with AI, automation, and digitization.

Client-centric Delivery

Client-centric delivery models to support organizations as they grow.

Risk Mitigation

Dedicated risk mitigation strategy ensures data security w/ E&O coverage.

Operational Methodology

A proven operational excellence model that accelerates transformation.

Global Culture & People

A global culture powered by 6,500+ employees.

Data protection powered by Patra Shield

SOC 2 Type 2 Compliance & ISO/IEC

Patra maintains SOC 2 Type 2 compliance and ISO/IEC 27001:2022 certification to ensure the safety and privacy of the insurance ecosystem’s data. Our compliance certifications relate to the principles of security, availability, and confidentiality as the framework for safeguarding data.

Business continuity &

disaster recovery

Patra ensures operational resilience through comprehensive business continuity and disaster recovery plans.

Global centers for

processing excellence

Patra’s global centers for processing excellence are distributed across geo-politically stable, democratic countries.

Indemnity

protection

Every process performed by Patra’s global process executive team is backed by market-leading error and omission liability assumption.

Would you like to learn more?

Don't hesitate. Unlock growth with exceptional automation and workflow optimization.

Trending topics, videos and announcements

Patra OnDemand in mShift

Patra and mShift partner to deliver OnDemand services

AI SaaS press release

Patra AI SaaS subscription pricing announcement