How benefits administration solutions reduce burnout and turnover

The insurance industry faces a talent crisis. High turnover and burnout are systemic challenges that threaten operational continuity and client satisfaction. Patra’s benefits solutions offer a strategic way to address these issues by streamlining processes, reducing manual workloads, and improving employee experience.

By automating repetitive tasks and centralizing employee benefits services, agencies reduce the administrative burden on their operations teams. This improves efficiency and enhances engagement—critical factors in reducing turnover and burnout.

Rising turnover disrupts continuity and increases costs

Turnover in insurance administration roles has surged in recent years, with some firms reporting rates as high as 15%. This constant churn leads to increased recruitment and training costs, not to mention the loss of institutional knowledge and client trust.

- Increased hiring costs:

Replacing an employee can cost up to 33% of their annual salary. - Training gaps:

New hires require time and resources to reach full productivity. - Client dissatisfaction:

Frequent staff changes can disrupt service continuity and erode client confidence.

Our solutions help stabilize teams by improving employee satisfaction and reducing the administrative burden that often leads to burnout. With streamlined onboarding and lifecycle management, agency employees feel more supported and are more likely to stay.

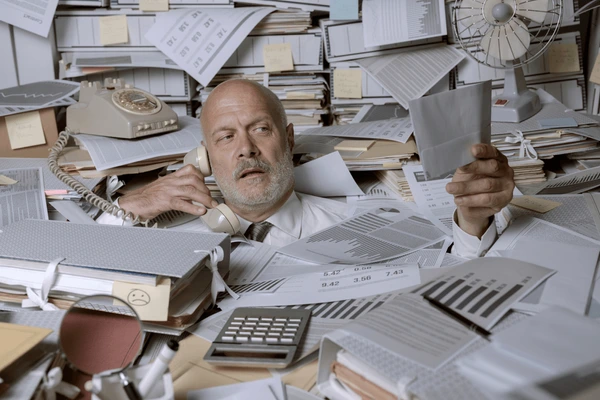

Burnout from manual processes is driving disengagement

Insurance professionals often face overwhelming workloads, especially in benefits processing. Manual data entry, compliance tracking, and error resolution can lead to fatigue and disengagement.

- Repetitive tasks:

Manual processes consume time and reduce job satisfaction. - Compliance pressure:

Constantly changing regulations add stress to already burdened teams. - Lack of support:

Without the right tools, employees feel unsupported and overworked.

Patra’s benefits solutions automate routine tasks, freeing up staff to focus on higher-value work. This not only reduces burnout but also improves accuracy and compliance

Fragmented systems create inefficiencies and errors

Many insurance organizations still rely on outdated or siloed systems to manage employee benefits for their clients. This fragmentation leads to data inconsistencies, missed deadlines, and compliance risks.

- Data silos:

Disconnected workflows make it hard to track employee benefits across the lifecycle. - Manual handoffs:

Increase the risk of errors and delays. - Limited visibility:

Managers struggle to get a clear view of benefits utilization and performance.

Patra’s integrated benefits administration platform unifies data and automates lifecycle management. This ensures accuracy, improves compliance, and reduces the administrative burden on HR teams.

Employee expectations are evolving rapidly

Today’s workforce expects more than just a paycheck—they want meaningful benefits, flexibility, and support for their well-being. When these expectations aren’t met, burnout and attrition follow.

- Well-being matters:

Employees want benefits that support mental, physical, and financial health. - Personalization is key:

One-size-fits-all benefits packages no longer cut it. - Communication gaps:

Poor communication around benefits leads to underutilization and frustration.

Patra’s employee benefits solutions help organizations deliver personalized, responsive benefits experiences. With tools that support the full employee lifecycle, HR teams can meet evolving expectations and foster loyalty.

Legacy carriers struggle to compete with InsurTech

Traditional insurance agencies often lag behind newer entrants in delivering modern, tech-enabled benefits experiences. This puts them at a disadvantage in attracting and retaining top talent.

- Outdated systems:

Legacy platforms can’t keep up with modern demands. - Slow innovation:

Internal IT teams are often stretched thin. - Talent drain:

Top performers are drawn to more agile, tech-savvy employers.

Patra’s administration solutions bring digital agility to legacy carriers. With scalable, cloud-based tools, insurers can modernize their operations and offer competitive employee benefits services.

Conclusion

Burnout and turnover are costly and disruptive. Standardizing benefits administration with Patra’s solutions reduces stress, improves retention, and enhances compliance. By automating processes and supporting the full employee lifecycle, Patra helps insurance organizations build resilient, satisfied teams ready for long-term success.

Struggling with high employee turnover?

Find out how Patra’s benefits solutions help you retain top talent by improving employee satisfaction and reducing administrative overload.

Recap

- Turnover disrupts continuity and increases costs.

- Manual processes drive burnout and disengagement.

- Fragmented systems create inefficiencies and compliance risks.

- Employee expectations demand personalization and well-being support.

- Legacy carriers need digital agility to compete.

Frequently asked questions

These are services Patra provides that help organizations manage employee benefits programs, including eligibility processing, compliance, communication, and lifecycle management. These solutions streamline processes, reduce errors, and improve the employee experience.

By automating repetitive tasks and centralizing benefits data, these solutions reduce the administrative burden on HR and operations teams. This leads to less stress, fewer errors, and more time for strategic work—key factors in reducing burnout.

Yes. By enhancing employee satisfaction and reducing workload, these solutions help organizations retain talent and reduce costly turnover.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.