Practical AI solutions for top backlog areas identified in polling

Let’s address each of the top backlog areas identified in our polling with specific, practical applications of current AI technology.

A. Policy checking: From 90 minutes to 10 minutes

The traditional policy checking workflow requires an insurance professional to:

- Download and open the policy document

- Open the application or submission information in the AMS

- Manually compare dozens or hundreds of data points

- Create a spreadsheet or document noting discrepancies

- Follow up on issues and document corrections

The AI-centric approach transforms this into a streamlined workflow:

- Upload the policy document to an AI platform (via portal, API, email, or AMS integration)

- AI extracts and structures all relevant policy data

- AI compares policy data against submission information

- AI generates a comprehensive check report highlighting discrepancies

- Insurance professional reviews and validates the AI's findings (5-10 minutes)

- System delivers results via preferred method (document download, API, AMS integration)

The time savings are dramatic, but equally important is the consistency. Unlike manual checking, which varies based on who’s doing the work and how much time they have, AI-powered checking applies the same rigorous standards to every policy, whether it’s a $500 premium or a $50,000 premium account.

B. Quote comparisons: Eliminating the spreadsheet nightmare

Anyone who's built quote comparison spreadsheets knows the pain: manually extracting data from multiple carrier quotes, ensuring consistent formatting, double-checking figures, and creating a professional-looking comparison that clients can use. AI-powered quote comparison eliminates this manual work by:

- Automatically extracting coverage details, premiums, and terms from multiple carrier quotes

- Standardizing data for apples-to-apples comparison

- Highlighting key differences and coverage gaps

- Generating professional comparison documents in minutes instead of hours

For agencies managing dozens of quotes daily, this transforms a bottleneck into a competitive advantage, faster turnaround times that impress clients and win business.

C. Coverage gap analysis: From reactive to proactive

Coverage gap analysis has traditionally been labor-intensive enough that many agencies only perform it during renewals or when clients specifically request it. With AI-powered structured data extraction, agencies can:

- Automatically identify potential coverage gaps across client portfolios

- Compare existing coverage against industry benchmarks or client risk profiles

- Prioritize outreach based on exposure levels

- Move from reactive service to proactive risk consulting

D. Contract review/compliance: Consistency at scale

Reviewing contracts, policy forms, and compliance documents requires deep insurance knowledge and careful attention to detail. AI doesn't replace this expertise but enhances it by:

- Identifying key terms, conditions, and compliance requirements consistently

- Flagging unusual provisions or potential issues for human review

- Maintaining audit trails and documentation automatically

- Enabling faster turnaround on contract reviews without sacrificing thoroughness

The workstream flexibility framework: Choosing the right approach

Here’s where AI implementation gets strategic. Not every policy check needs the same level of service. Not every quote comparison requires human oversight. The most sophisticated agencies are implementing workstream flexibility, the ability to dynamically adjust how AI-powered solutions and human-in-the-loop combine based on specific situation requirements.

Think of it as having multiple gears instead of one fixed speed. You can shift between approaches based on:

The four workstream options defined and explained

AI-only processing:

Straight-through processing with no human review. AI extracts, analyzes, and delivers results in minutes. This approach works well for agencies with internal expertise who want to maintain oversight of the review process and are comfortable with moderate risk assumption. It's the fastest and most cost-effective option for high-volume, routine work.Self-service:

In-house teams access AI-powered platform directly through intuitive interfaces. Insurance professionals maintain complete process control while leveraging sophisticated AI automation. Results are immediate, risk assumption is low because your team validates the output, and turnaround time is typically around 10 minutes. This option suits agencies that want AI power with internal oversight.Full-service:

AI technology combined with dedicated insurance professionals who manage the entire process and provide final verification. The service provider assumes E&O risk, delivers results in under one business day, and ensures the lowest risk assumption for your agency. This is ideal for agencies that want to free their teams from document-heavy work entirely while maintaining the highest quality standards.Custom/white-glove service:

Comprehensive processing with customized quality control measures, reporting, and service level agreements aligned to your specific operational needs. Like full-service, the provider assumes E&O risk, but workflows are designed specifically for your unique requirements. Turnaround times are longer (typically under 15 business days) but support all commercial and personal lines, including specialty coverage.

The strategic advantage:

Agencies implementing workstream flexibility aren’t locked into a single approach. They can use AI-only for routine personal lines policies, self-service for standard commercial accounts where their team wants oversight, and full-service for complex or high-premium business. This flexibility optimizes both cost and risk management.

Making your move: Guidance based on where you stand

Based on the webinar polling data, here’s guidance tailored to each segment of the AI adoption curve.

1. For the 50% already using AI

Ask yourself these critical questions:

- Are you seeing measurable ROI, or just marginal efficiency gains?

- Does your current solution manage document variation and non-standard forms effectively?

- Are you still doing extensive manual cleanup or verification?

- Can your solution scale to address your biggest operational backlogs?

If you’re answering “no” to these questions, you may be working with foundation-level tools when AI-centric workflows could deliver significantly more value. Consider evaluating current-generation solutions that leverage LLMs, and advanced AI models specifically trained on insurance documents.

Key evaluation criteria:

- Accuracy rates on your specific lines of business

- Ability to manage complex forms and endorsements

- Integration capabilities with your existing systems

- Workstream flexibility to match different use cases

- Provider track record and insurance industry expertise

2. For the 41% actively researching in 2025

You're in a strong position to learn from early adopters while implementing proven solutions. Focus your evaluation on:

Technical capabilities:

- What percentage of fields can the solution accurately extract from your policy documents?

- How does it manage non-standard forms, endorsements, and manuscript coverage?

- What validation mechanisms ensure accuracy?

- How does the technology adapt and improve over time?

Implementation approach:

- What's the typical implementation timeline?

- What integration options are available (API, AMS connectors, portal upload, email)?

- How much internal IT resources will be required?

- What training and change management support are provided?

Business model and risk:

- What pricing models are available (per-transaction, subscription, volume-based)?

- What workstream options exist to match your risk tolerance?

- Does the provider offer E&O coverage on their work?

- What service level agreements are standard?

Vendor considerations:

- How long has the provider been focused on insurance?

- What's their track record with agencies your size?

- Are they a technology vendor or an insurance services company with AI capabilities?

- What's their product roadmap and investment in continued innovation?

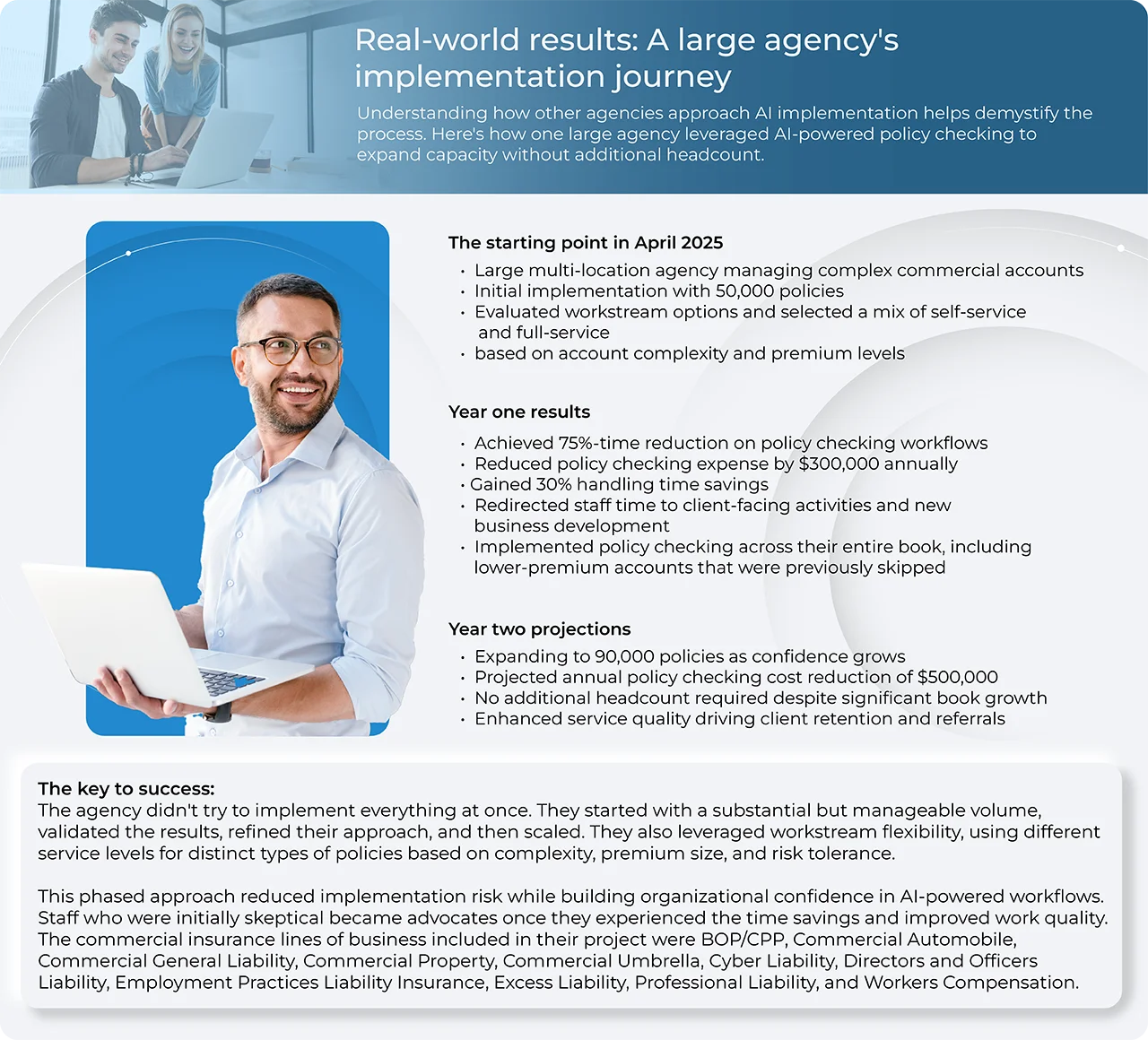

Start strategically: Like the case study agency, consider beginning with a specific use case (like policy checking for your top commercial lines) where the pain point is clear and the ROI is measurable. Validate results, build confidence, and then expand.

3. For the 9% planning for 2026

You have the advantage of learning from early adopters' experiences, but don't wait too long. The competitive landscape is shifting as agencies with AI-powered operations deliver faster service, more consistent quality, and greater capacity than those still operating manually.

Consider these realities:

- Your competitors in the 50% cohort are already capturing efficiency gains

- The technology is proven and mature enough for production use

- Labor market constraints make hiring additional staff increasingly difficult

- Client expectations for speed and service quality continue to rise

Your planning should focus on:

- Identifying your highest-impact use case (policy checking based on industry data)

- Budgeting for both technology costs and implementation resources

- Beginning vendor evaluation now so you can move quickly when ready

- Assessing internal change management needs and preparing your team

The path forward

The polling data from NetVU’s insurance community tells a clear story: AI has moved from experimental technology to operational necessity. Half the industry is already implementing solutions, and another 41% are actively researching, not because of technology hype, but because operational realities demand innovative approaches.

Policy checking, quote comparison, coverage gap analysis, and contract review create backlogs that manual processes can’t manage at scale. The agencies succeeding with AI aren’t looking for futuristic autonomous agents, they’re implementing proven, AI-centric workflows that deliver measurable results today.

The key is understanding where you are on the adoption curve, what level of AI sophistication you need, and how to implement workstream flexibility that matches your specific operational requirements. Whether you’re at the foundation level looking to upgrade, actively researching solutions, or planning your 2026 strategy, the path forward is clearer than ever: start with your biggest backlog, choose proven technology with workstream flexibility, implement strategically, and scale based on results.

The agencies that master this approach won’t just solve operational bottlenecks, they’ll transform document-heavy work into competitive advantages, freeing their teams to focus on what matters most: advising clients, building relationships, and growing their business.

Key AI Terms for Insurance Professionals

Artificial Intelligence (AI):

A machine's ability to perform cognitive functions usually associated with human minds—like understanding documents, making comparisons, and identifying patterns.Machine Learning (ML):

A subset of AI that analyzes data to make predictions and improve performance over time without being explicitly programmed for every scenario.Natural Language Processing (NLP):

Technology that enables computers to understand human language, including the complex terminology and structure of insurance documents.Large Language Model (LLM):

Advanced AI systems that understand and generate human language to perform tasks like answering questions, summarizing text, and extracting structured data from unstructured documents.Agentic AI:

AI systems designed to act autonomously within defined parameters, making tactical decisions without constant human intervention—like routing different document types to appropriate processing workflows.AI-Centric Workflows:

Complete operational processes that combine advanced AI models with structured human oversight to manage document-heavy work from start to finish.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.