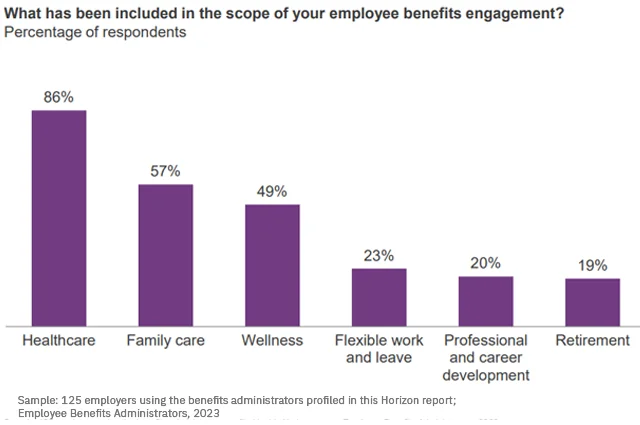

Today, revenue growth in the employee benefits sector is driven primarily by inflation and increasing prices rather than an improvement in outcomes – which is what today’s employers are seeking. Nearly 60% of employers surveyed expect their benefits partners to go beyond traditional costs or experiences and impact on health and financial outcomes, while 48% focus on enhancing the experience associated with the consumption of benefits.

Market consolidation and technology adoption: New complexities

Today’s competitive insurance brokerage market has undergone significant consolidation over the last five years, according to HFS Horizons research. Brokers, agencies, and HRIS enterprises are either merging to broaden their range of products and services or engaging in vertical integration by acquiring complementary businesses to enhance their service portfolios.

Insurance brokers and agencies have adopted technologies to aggregate, package, and distribute benefits faster and easier. However, these technologies have added layers of operational complexity, creating an intricate web of systems, carriers, and employer needs that must be managed.

Despite broad technology adoption, brokerages still use manual approaches for critical tasks. Group builds (case builds) and renewals are fundamental operations that play vital roles in each phase of the benefits management lifecycle. When problems occur in these processes, they create cascading issues throughout the entire employee benefits lifecycle, which is already experiencing significant disruption due to economic turbulence, mass layoffs, and evolving federal legislative dynamics.

Pre-renewal challenges: Evolving regulations

Employee benefits are a complex arena to navigate from a regulatory perspective. Regulations remain onerous and are becoming materially expensive to address and remain compliant with. Brokers must help employers comply with healthcare regulations (ACA, OWCP), financial regulations (ERISA), and other employee benefits regulations at both the federal and state levels.

Evolving federal regulations—from healthcare and retirement policies to immigration and trade decisions—create continuous compliance challenges for benefits administrators. Each regulatory shift requires brokers to quickly interpret implications, communicate changes to employers, and implement modifications across multiple systems.

Open enrollment challenges: Unique workforce demographics

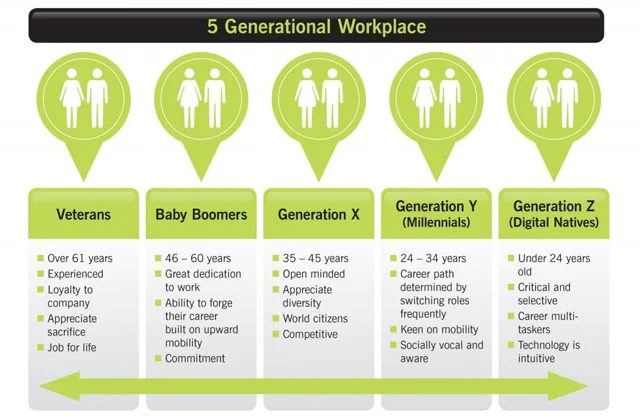

The “one size fits all” value proposition of traditional employee benefits administration has not changed in decades. Many brokers embrace the role of a line-item benefits aggregator—packaged, bundled, and sold to employers with limited focus on efficacy or outcomes. This paradigm has lost purpose and value. Today’s global workforce includes five generations, and employers must address employees’ needs differently.

Case builds should enable smooth execution of the enrollment process, but a typical case build for a mid-sized employer with multiple plan offerings can consume up to 20 hours of an account manager’s time. This manual burden leads to higher error rates requiring rework, creating a cycle of corrections that extends timelines during the most visible phase to employers and their employees. Delayed implementation schedules can impact employee enrollment periods and create negative impressions of both the broker and the employer’s benefits program.

Post-enrollment challenges: A softening labor market

Layoffs in the United States reached a five-month high in August, exceeding 75,000 job cuts, highlighting growing economic uncertainty and signs of a weakening labor market, according to a Challenger, Gray & Christmas report. This represented a significant increase of 193% compared to July and marked the highest monthly total since March. Excluding the 2020 pandemic, this past August saw the highest job losses recorded in the month since 2009.

While the technology sector led in layoffs, no industry has been spared. Employee confidence has also plunged to historic lows, with just 44.4% of employees optimistic about their company’s six-month outlook, the lowest recorded figure since tracking began in 2016.

Case builds facilitate mid-year plan changes as employees experience life events or employers adjust their offerings. But frequent onboarding and offboarding (combined with manual case builds and renewals) impacts scalability and creates bottlenecks which affect service delivery when employers need responsive service the most. Manual processes often result in inconsistent quality across different account teams, leading to unpredictable outcomes and experiences.

Renewal challenges: Administrative task overload

As the cycle begins again, case builds support new plan year setup with updated information, while renewals drive the annual update cycle that keeps benefits programs current and competitive. But amid the disrupted employee benefits lifecycle, today’s account managers at brokerages are overloaded with basic administrative functions, leaving little capacity for strategic client consultations, relationship building, proactive problem-solving, or thorough market analysis, the high-value activities that truly drive employer satisfaction and retention.

The way forward

The challenges facing employee benefits administration today require a transformation in how brokers and agencies approach their fundamental processes and service delivery. Despite the obstacles, there is a clear path forward for forward-thinking organizations willing to evolve.

In Part 2 of this series, we’ll explore how strategic benefits management solutions are helping innovative brokers and agencies reclaim their value proposition, improve operational efficiency, and deliver the measurable outcomes that today’s employers demand.

Transform Your Employee Benefits Management

Learn how Patra’s modernized approach can help your agency reduce costs, improve efficiency, and deliver better client service.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.