Hi. This is John Umstead with Solstice Innovations.

On this episode of the SIP, our guest is Steve Forte, who’s the director of product marketing at Patra Corporation.

Alright. So we’re here with Steve Forte of Patra.

Steve, thanks for taking some time to be with us here on the SIP. Why don’t we get started by having you introduce yourself and tell us a little bit about your role as well as, Patra’s mission?

Great. Yeah. Thank you. Thank you for having us, John, on on the podcast today. So, my role at Powcher is product marketing. So I’m actually the first product marketing hire, and the goal was because we’ve moved into more of the software space, traditionally, we have been an outsourcer, of back office and front office processes for retail agencies, brokers, wholesalers, NGAs, NGOs, and carriers.

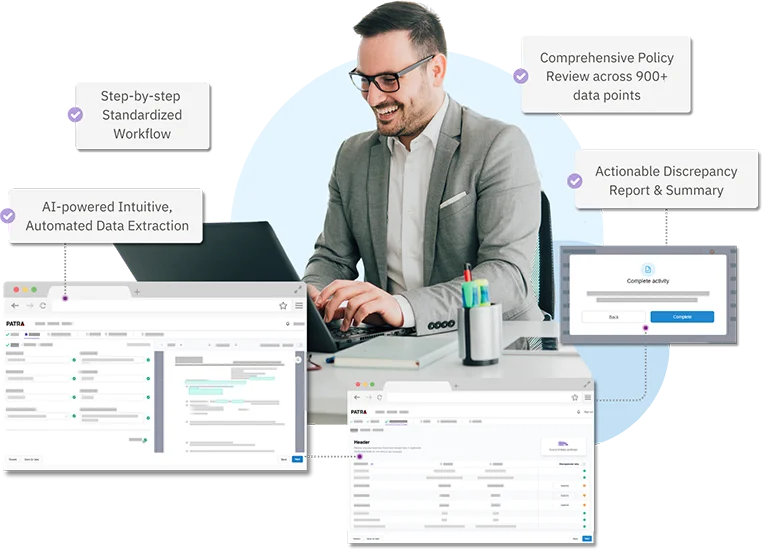

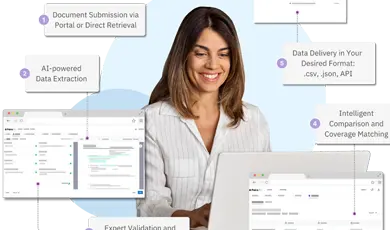

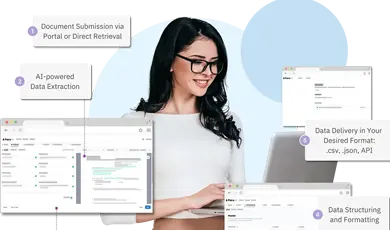

But, you know, last year, we started, creating software and specifically our policy checking AI solution. And so the thought was to bring in somebody in product marketing to kind of tie in everything between marketing, sales, and product, and lead the go to market efforts for that. So that’s, that that’s how I, came about on this role in Patra.

You know, what drew me here was the interesting dynamic of Patra solving a problem that’s been existence for a long time at at in the insurance industry, and that’s, all of the manual processes and the heavy documents that go on in in the insurance workflows. And so, you know, you could have your account manager drowning in these type of manual processes and all the documents whether, you know, you’re talking loss runs or agency inspections, quotes, policy checks, etcetera.

And so the idea was to offload that burden, for our customers and allow them to do the things that, bring value, to their customers, better underwriting, and better processing overall. So the the philosophy for us is taking technology and human expertise and bringing that in the equation to shift the burden from our customers so it allows them to do what they do best.

Yeah. You know, and speaking of that, you’ve you’ve probably seen over especially over the last few years, back off the back office side of things and how it’s, transforming, fairly rapidly. So what do you think some of the biggest drivers of that change, are, and where do you see things headed next?

Yeah.

So the three things I think of are, customer expectations.

Let’s face it. Nowadays, people expect an Amazon level speed and transparency in their processing.

We’ve also got a large talent shortage in the industry as well. And you think about people coming out of either high school or coming out of university, coming into the insurance industry, and, you know, they are kinda their expectations are that they’re gonna be able to use the technology that they use in their everyday lives. If they can’t process things with a smart device, they’re gonna question that. You know, here’s a good example.

A new person comes in, they’re an account manager at an agency, and they say, okay. Hey. You know what? We’ve got our July renewals are coming up.

It’s a big time of year for us. We’ve gotta go through and check all of these policies, and there’s thousands of them. Okay? And okay.

Well, how do I do that? Oh, well, here’s all the files, and then you go into the conference room over there and spread them out and take the renewal policies, look at the the, you know, the new policies coming up, and make sure the coverages, endorsements, forms, etcetera, are all correct. And if there’s any changes, make sure that you, check those and see if did they need to make the changes or were they errors.

Are they really gonna wanna do that?

They’re probably gonna be like, no. It’s okay. I’m gonna go somewhere else. So so really, it’s it’s getting that technology in your agency to be able to bring in the talent so they wanna do the kind of work that’s out there. And with that, there’s a lot of data that’s been trapped in all these PDFs that we that, companies have. So it’s being able to extract that data that’s out of there, and then companies can use their BI tools or build data lakes and and have some more actionable insights.

Really what I think, you know, for our next wave, it’s gonna be in making coverage adjustments. So you’ll be able to use AI tools and figure out, hey. Does our risk need to have different coverages?

Cross sell opportunities, predictive claim risk, those sort of things. And, you know, what really I think the big thing that excites me is, especially with the AI, is not just AI itself, but it’s the human in the loop. It’s the AI taking some of that manual burden and task off of the off of the individual and allowing them to focus and do what they do best. So in other words so your your underwriters for an NJ, for example, are not doing data entry work. They’re actually doing risk assessment and pricing risk risk to exposure as opposed to all the manual processing that they normally do.

That kinda ties into the the next question I have. And and you’ve you’ve hit some of it, but let me ask it more directly. So when you’re looking at technology versus people and the functions and tasks that need to be performed, how do you decide which one should be, or could be automated or performed by AI versus handled by those skilled people?

Yeah. So look at if we look at a framework, it’s really three things. So it’s it’s, volume, complexity, and risk.

So the prime automation candidates are high volume, low complexity, standardized rules, standardized workflows. So your basic data entry processing, basic policy checking, maybe some quote comparisons, loss runs, those sort of things.

You know, the AI tools are gonna get tired. They’re gonna keep functioning and chugging along.

Where the human shine, where they come in is being able to provide the judgment, the relationship building, complex problem solving skills.

And so that’s really why we push Apatria anyway, the human in the loop. So it’s not just only tech, and you’ll see a lot of that in the industry. And that’s going to happen more so with, smaller insure techs where they push, you know, the AI only solutions.

Well, that’s good.

But do you really trust AI one hundred percent to do everything that you wanna do?

You know, I mean, even machines make mistakes that are human programmed. Right. So there’s always gotta be that person in the loop to be able to validate what’s coming out there. So this way, when you bring that back into your customer, they’re getting back the quality, data that they need. So, really, what you wanna look at is it’s not so much what can AI do, it’s how can AI make our people more effective, more successful.

I like looking at it that way, and I appreciate the definition that you gave in in that overall answer. So that’s really good.

So next question then. You know, as, you know, a lot of carriers and JAs agencies struggle a little bit with how do you scale up or scale beyond where you are today. So what are some of the biggest mistakes or more common mistakes that that you see companies going through out there that are looking to, looking to grow, but perhaps don’t have the right operational support?

Yeah. It’s a great question, John. I I think the biggest mistake we see is linear scaling. What I mean by that is just adding people, to a problem and doing the same manual processing.

So it’s it’s like this vicious cycle they get into. You have more headcount. It’s harder to communicate. You have inconsistent quality, and you get spiraling costs. That’s not gonna solve anything.

Then what happens is your best people get bogged down in administration work versus driving growth, building relationships, those sort of things.

So and then companies kinda get afraid to write new business because they’re too bogged down with managing their existing customers. They can’t go after, greenfield opportunities and those sort of things.

I think the second mistake that we see is that, technology alone without having a process redesign. And what I mean by that is you take technology and, you know, the old analogy of paving a cow path. You got a faster, way that goes absolutely nowhere, and what good is that gonna do? So, ideally, what companies need to do is what, you know, operational transformation, not just expansion. So you redesign processes around efficiency.

You implement intelligent automation, and you create systems that can scale independent of headcount.

So when you look at operations as competitive advantage at that point, it’s not just cost center.

That makes a lot of sense. And, you know, we’re Solstice is a software as a service, provider, and and we go through the same things. You know, we might have, some technical debt that that stacks up. Right? But there’s a point in time where just throwing more bodies at it doesn’t help. It creates more problems than it than it solves.

Right. So Makes sense.

Yeah. Very, very similar. So and another similarity. So, you know, with Solstice, we have we have teams that are global, couple primary locations in the US as well as outside of.

Is does Patrick follow a similar model?

We do. Yeah. We have, here in the US and then, you know, globally as well, we have process centers.

How do you, and and it’s okay. It’s fair if you if you’re don’t really have an answer for this, but how do you kinda maintain a consistent culture, of quality of service across those, different regions and time zones?

Yeah. The the biggest thing for us, you know, when being in, you know, geopolitically stable and democratic countries that, you know, protect our data and customers’ data, but it’s not just about compliance. Right? It’s it’s shared values and and legal frameworks. So their secret weapon really is insurance DNA.

So when people come on board and join Patra, it’s insurance education for everyone. You know? We wanna make sure that they’re not just data processors. They understand policy structures, coverage of implementations, implications, and regulations.

And we’re all working on same workflows. We have quality metrics that we’re using. We’re all using the same AI tools. So here’s an example.

We have a solution policy checking AI.

For the longest time, we were doing policy checking on a manual basis for our customers. They’re outsourcing it to us, and then we developed an AI tool to be able to, you know, provide better outcomes, processing, etcetera.

And that way, our teams were doing it. So they were turning around and getting the information back to our customers, and they really like this a lot. And some of the smaller, you know, customers said, hey. Is there a way that we can have access to this tool?

So, okay. So we started selling it to them as well. So, you know, we’re using technology not only for the benefit of our customers when they’re outsourcing it to us, but we’re then also selling that to, you know, companies who don’t wanna outsource, and they wanna have that control within house. So it’s nice.

You know, we’re drinking our own, champagne.

Yeah. But ultimately, we’re building a culture of accountability and recognition.

So it’s you know, we’re using real time quality metrics, and we celebrate our excellence when it happens. And, you know, we’ve got a lot of sharing on innovations throughout the community.

Not only for your prospects, but just in general as, as MGAs, etcetera, or your your, your target market is thinking about, operational outsourcing.

What kind of advice would you give them? What things should they consider?

So the biggest thing is you start with an assessment. Understand where does the team spend their time versus creating value. So you look at your key people.

Are they bogged down with operational tasks versus, like, prospecting or building relationships?

You’re an MGA. Are your underwriters doing data entry, or are they doing risk analysis and pricing risk risk to exposure, which is what they should be doing?

So we’d like to advise our customers, start small. Find where your biggest pain points are first because you don’t wanna do everything at once. Yeah. So maybe it’s policy reviews that we talked about earlier. That is the biggest bottleneck for you, so outsource that.

And you wanna make sure that you’ve got clear before and after results. You just wanna get don’t wanna outsource just to outsource something to get it off your plate. You wanna make sure that you’re not outsourcing problems. You’re outsourcing to solutions.

And you wanna partner with, obviously, somebody who has insurance expertise.

That goes without saying.

Yeah. Goes without saying. Although you see it all the time. Right? Somebody uses a a low cost provider because they can throw bodies at it.

Yes.

But they aren’t the right bodies.

So Yeah.

If the if the output comes back wrong, what good is that? How how did that help you? So you save money on on an hourly rate, but if the information you got back is wrong, you’re not gonna present that to your customer.

Right.

Right?

Right. Right.

Yeah. So you hit a lot of these, points, but as we begin to close down the conversation here, if you could give just one piece of advice, operational advice, for insurance leaders, in twenty twenty five and even into twenty twenty six, what would it be?

I’d say the biggest thing is, stop optimizing yesterday’s processes and start designing tomorrow’s capabilities.

So the problem you see is there’s in incremental improvements to fundamentally broken workflows.

So instead of asking, how can we do this ten percent faster or ten percent less expensive, you should really be asking, should we even be doing this at all?

So really, the opportunity is, with AI especially is that plus intelligent automation, you can unlock an entirely new set of capabilities.

So, instead of faster policy checking, it’s real time risk and monitoring with AI. Instead of quick quote comparisons, for example, it could be predictive pricing and optimization.

So, you know, really, organizations that embrace these operational transformations will gain a competitive advantage in the coming years.

Great answer. I love it. Absolutely spot on. Before we wrap up, do you have anything else that you’d like to talk about that we haven’t covered?

No. I think we actually covered, a lot of ground here, John. I appreciate your time. This was good.

Yeah. Thank you. Appreciate it very much, Steve Forte of Patra. Again, thanks for being on the SIP, and I wish you well.

Thank you, John. Thank you for having us, and wish you well as well.