Solution highlights

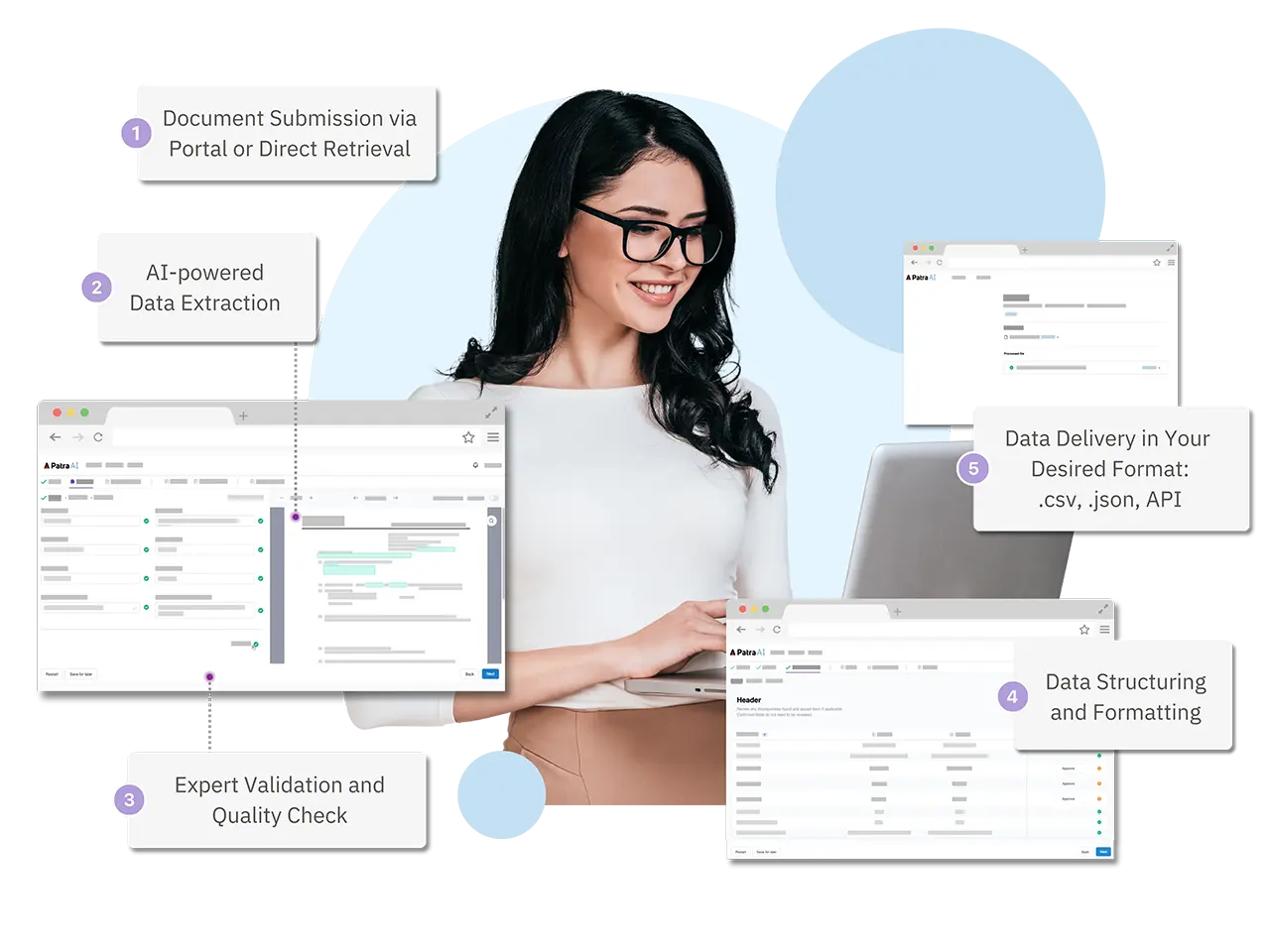

In the modern data-driven insurance landscape, valuable business intelligence remains trapped in thousands of unstructured policy documents. Patra’s Policy Data Extract AI bridges the gap between unstructured documents and actionable insights, enabling insurance organizations to make data-driven decisions and scale operations efficiently.

Don't let manual processes erode your market position

- Staff spends 70% of time on manual data entry instead of revenue-generating activities

- Data silos prevent cross-sell identification and strategic growth

- Operational costs remain 40% higher than necessary

- Market position erodes as competitors adopt modern solutions

AI-powered operational efficiency

entry time

data extraction

manual validation

Connect with our insurance professionals

Our team of experts can help across all facets of the insurance market and operations. Learn how AI can power your business into the future.

Sophisticated AI for unprecedented accuracy

Diverse document processing

Insurance organizations handle diverse document types, each containing crucial information for operations and analysis. Patra’s AI technology processes all major commercial lines documents while maintaining consistent accuracy and standardization.

- Multiple document type support

- Automated data identification

- Format-independent processing

- High-volume capability

Accurate data extraction

Accurate data extraction requires a deep understanding of insurance documentation and terminology. Patra’s solution comprehends complex insurance contexts, ensuring meaningful data capture across all document types.

- Comprehensive coverage details

- Policy limits and sub-limits

- Exposure information

- Schedule data

- Forms and endorsements

Flexible, structured data output

Modern insurance operations require flexible, standardized data output for various business purposes. Patra’s Policy Data Extract AI delivers structured data ready for immediate use in your preferred systems.

- Standardized CSV format

- Data lake integration

- Business intelligence ready

- System-agnostic output

Impact on strategic growth

sell identification

renewal retention

recognized

Benefits for your business

Insurance distributors face unique challenges in managing and utilizing policy data. Patra’s Policy Data Extract AI delivers specific benefits tailored to each segment’s operational needs and growth objectives.

Transform your policy data management

Ready to unlock the value hidden in your policy documents? Schedule a demonstration today to see how Patra’s Policy Data Extract AI can transform your operations and drive better business outcomes.

Frequently asked questions

Patra’s solution enables detailed profitability analysis across various dimensions including industry, size, location, and coverage type. Retail agents and brokers can track revenue, costs, and margins at both individual policyholder and portfolio levels.

Policy Data Extract AI supports nine major commercial insurance lines of business, representing approximately 85% of premium volume in the commercial insurance market. Our solution is designed to handle the most common and complex commercial insurance needs including BOP/CPP, Commercial Automobile, Commercial General Liability, Commercial Property, Commercial Umbrella, Cyber Liability, Excess Liability, Professional Liability, and Workers Compensation.

Patra’s solution is designed to process policies from any carrier or program, maintaining consistent data structure while accounting for carrier-specific variations. It can handle complex program structures and multiple carrier relationships efficiently.

Patra’s Policy Data Extract AI can process both standard and program-specific forms, maintaining accuracy across different document types. Patra works with MGAs/MGUs to ensure all program-specific documents are handled correctly.

Yes, Patra currently offers three AI-powered services for retail agencies and brokers, wholesalers, and MGAs/MGUs. Please visit the Patra AI webpage for more information.