Addressing the unique challenges of retail agencies and brokers

- Manual processing consumes valuable staff time that could be dedicated to revenue-generating activities

- High error rates in document handling increase E&O exposure

- Inconsistent workflows lead to quality and service variations

- Delayed response times affect client satisfaction and close rates

- Scaling operations traditionally require proportional staff increases

Retail agencies and brokers can no longer afford to continue to operate with the same generic technology and manual processes if they want to grow their business. They need to adopt AI in insurance solutions or face becoming irrelevant in the market.

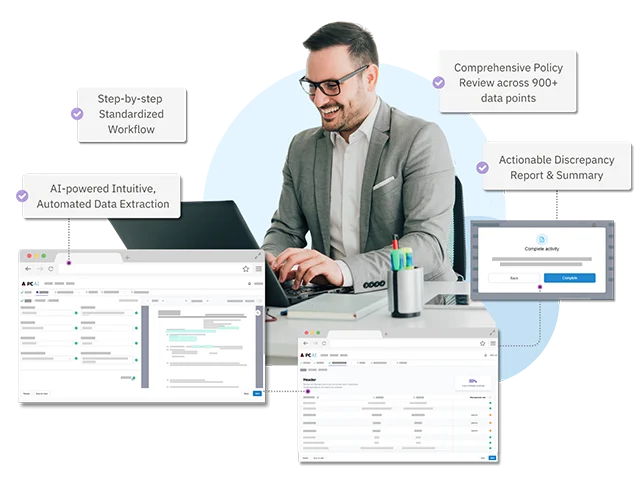

The Patra AI platform: Purpose-built for insurance professionals

The Patra AI Platform represents a transformative approach to AI in insurance automation, combining three powerful AI-powered solutions specifically designed for insurance operations. Built on decades of insurance processing experience and trained on millions of insurance documents, the platform delivers unprecedented accuracy, efficiency, and scalability for retail agencies and brokers.

Policy Checking AI: Reduce E&O exposure while saving time

For retail agencies, insurance policy checking represents one of the most critical yet time-consuming processes. Policy Checking AI transforms this workflow with:

A comprehensive 900+ point checklist ensuring thorough review.

Automated comparison of policy documents against source materials.

Color-coded discrepancy reports for easy review.

Choice of implementation options to match your operational needs.

The impact is immediate and significant: reduce policy checking time by up to 75% while improving accuracy and reducing E&O exposure.

Quote Compare AI: Improve your client response times

In the competitive retail insurance market, quote response time can make the difference between winning and losing business. Quote Compare AI modernizes this process by:

Automatically extracting and analyzing data from quote documents.

Creating standardized comparisons.

Delivering comprehensive coverage and premium analysis.

Supporting complex commercial insurance quotes with precision.

Agencies implementing Quote Compare AI for their insurance quote comparison needs have transformed their quote comparison time from days to same-day response while increasing commercial lines close rates by up to 30%.

Policy Data Extract AI: Unlock growth opportunities

The valuable data trapped in your policy documents represents untapped growth potential. Policy Data Extract AI automatically extracts and structures this information with:

Industry-leading 99%+ accuracy.

Support for all major commercial lines.

Comprehensive capture of policy details, coverages, limits, and exposures.

Structured output ready for analytics and action.

With structured, accessible policy information for data extraction, retail agencies and brokers can leverage data extraction to identify cross-sell opportunities, enhance renewal strategies, and deliver data-driven client recommendations. Insurance organizations that embrace AI in insurance solutions today, can position themselves at the forefront of the industry’s digital transformation.

Workstream flexibility: Adapt to changing market conditions

The recently enhanced Patra AI Platform now offers expanded workstream flexibility through multiple service options, enabling retail agencies and brokers to:

- Instantly adjust to carrier appetite changes by redirecting resources

- Scale operations during peak seasons without adding staff

- Pivot resources during catastrophic events to maintain service continuity

- Choose the implementation model that best fits your operational needs

For example, with Policy Checking AI, you can now choose from four flexible service options:

- AI-Only: Streamlined automation without human review for maximum efficiency

- Self-Service: Direct access to AI technology for in-house teams

- Full-Service: Comprehensive managed service with E&O coverage

- Custom: White-glove service with tailored workflows and reporting

Similarly, Quote Compare AI offers three distinct options (AI-Only, Self-Service, and Full-Service) to match your specific requirements.

Customer success story: Retail agency transformation

Checking Time By

Unimaginable

Average Of

relationship building

Lines Close Rate

professional responses

“The combination of these AI solutions has transformed how we operate,” notes the agency’s operations director. “We’re not just more efficient; we’re providing better service and winning more business.”

Frequently asked questions

Most retail agencies and brokers begin seeing immediate operational benefits within the first week of implementation. Policy Checking AI and Quote Compare AI deliver instant time savings, while Policy Data Extract AI typically begins yielding actionable insights within the first month as your data repository grows. Full implementation across all workflows is typically completed within 30-60 days, with ROI achieved within the first three months.

Absolutely. While the integrated platform delivers maximum value when all solutions work together, many agencies start with a single solution that addresses their most pressing pain point. Policy Checking AI is often the first implementation, followed by Quote Compare AI, with Policy Data Extract AI added as the agency becomes ready to leverage data analytics for growth. Patra’s flexible implementation approach ensures you can expand at your own pace.

The workstream flexibility options allow your agency to quickly adapt to changing conditions without disrupting operations. For example, during catastrophic events when your team needs to focus on client service, you can temporarily shift from self-service to full-service policy checking. Similarly, during peak renewal seasons, you can leverage additional AI-powered support without adding staff. This flexibility ensures continuity of operations regardless of market conditions, carrier changes, or seasonal fluctuations.

Ready to Transform Your Agency Operations?

The future of AI in insurance distribution belongs to agencies and brokers that effectively harness the power of AI to transform their operations. The Patra AI Platform represents a comprehensive opportunity to turn daily challenges into competitive advantages.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.