Addressing the unique challenges of wholesale operations

- Complex program management across multiple carriers and coverage forms

- High-volume submission processing with varying quality and completeness

- Intensive market analysis to identify optimal placement opportunities

- Demanding service expectations from retail partners

- Detailed compliance requirements that vary by program and line of business

In this increasingly competitive landscape, wholesalers that continue to rely on manual processes will find themselves at a significant disadvantage.

The Patra AI platform: Purpose-built for insurance wholesalers

The Patra AI Platform represents a transformative approach to wholesale insurance automation, combining three powerful AI-powered solutions specifically designed for complex insurance operations. Built on decades of insurance processing experience and trained on millions of insurance documents, the platform delivers unprecedented accuracy, efficiency, and scalability for wholesale operations.

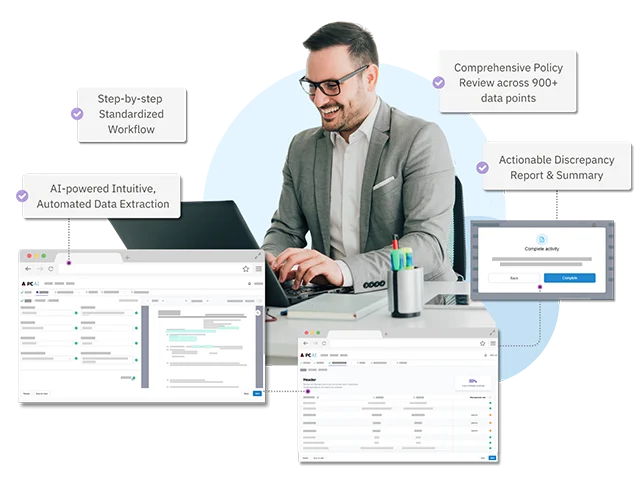

Policy Checking AI: Ensure program compliance and accuracy

For wholesalers, insurance policy checking is critical to program integrity and carrier relationship management. Policy Checking AI transforms this workflow with:

A comprehensive 900+ point checklist ensuring thorough review.

Automated comparison of policy documents against submission materials.

Color-coded discrepancy reports for easy review.

Choice of implementation options to match your operational model.

The impact is immediate and significant: reduce policy checking time by up to 75% while improving accuracy and enhancing program compliance monitoring.

Quote Compare AI: Transform placement efficiency

In insurance wholesalers’ operations, the ability to efficiently compare multiple market options can dramatically impact placement success. Quote Compare AI modernizes this process by:

Automatically extracting and analyzing data from complex quote documents.

Creating standardized comparisons across carriers.

Delivering comprehensive coverage and premium analysis for complex risks.

Supporting complex commercial insurance quotes with precision.

Insurance wholesalers implementing Quote Compare AI for their insurance quote comparison needs have renovated their complex property schedule comparison time from days to same day while improving placement efficiency by 30%.

Policy Data Extract AI: Enhance program analytics

The valuable data trapped in policy documents represents critical program intelligence. Policy Data Extract AI automatically extracts and structures this information with:

Industry-leading 99%+ accuracy.

Support for all major commercial lines and specialty programs.

Comprehensive capture of policy details, coverages, limits, and exposures.

Structured output ready for program analytics and carrier reporting.

With structured, accessible policy information for data extraction, wholesaler operations can develop deeper program insights, identify market trends, and strengthen carrier relationships through data-driven program management.

Workstream flexibility: Adapt to market capacity shifts

The recently enhanced Patra AI Platform now offers expanded workstream flexibility through multiple service options, enabling wholesale operations to:

- Rapidly deploy new risk solutions by redirecting resources

- Dynamically adjust to market capacity shifts without operational disruption

- Seamlessly adapt to retailer service needs without missing opportunities

- Choose the implementation model that best fits your operational requirements

For example, with Policy Checking AI, you can now choose from four flexible service options:

- AI-Only: Streamlined automation without human review for maximum efficiency

- Self-Service: Direct access to AI technology for in-house teams

- Full-Service: Comprehensive managed service with E&O coverage

- Custom: White-glove service with tailored workflows and reporting

Similarly, Quote Compare AI offers three distinct options (AI-Only, Self-Service, and Full-Service) to match your specific requirements.

Success story: Wholesaler operational excellence

A growing insurance wholesalers operation leveraging Patra AI’s integrated capabilities revolutionized their program business:

Reduced complex property schedule comparison time from 4 hours to 15 minutes.

Increased submission volume by 40% without adding staff.

Improved placement efficiency by 30%.

Enhanced retail partner satisfaction through faster response times.

Strengthened carrier relationships through better program data analysis.