I’m super excited, to get to talk to Steve Forte from Patra today.

Steve and I have had a couple conversations in the past and even just in the in the little back and forth we had before we started recording this particular conversation for Catalyit.

Steve mentioned the fact that, you know, he’s been, of course, an expert and well, he didn’t call himself an expert, but in in in his mouth, I view him as an expert.

Thanks, Casey.

Yeah. In the AI space, in the outsourcing space, a lot of agencies, leverage, the tools Patra makes available to them. And Steve even told me off camera that, you know, now kind of some additional kind of services and login and software, component to it that didn’t exist before. So I’ve rambled and just talked, to kind of intro. But, Steve, thanks for making some time and, being willing to share some information and feedback you have about, the state of the insurance industry and technology with our Catalyit members.

Yeah. I appreciate that, Casey. Thank you very much. Good introduction. I am gonna call myself an expert now.

I’m gonna have that as my monitor anywhere I go, so that’s great. I appreciate it. Absolutely. Yeah.

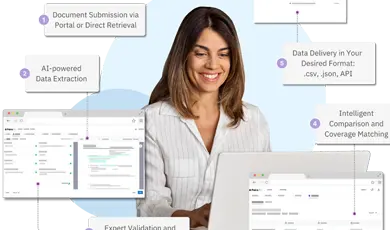

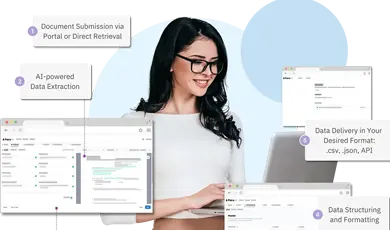

You know, I think it might be great to give people a little background on who Patra is really quick. I won’t get into a long, discussion on that, but, you know, we are a provider of tech enabled outsourcing services and AI powered solutions to property casualty insurance, insurance space as well as we have services also for the employee benefit space. We’ve been around for twenty years.

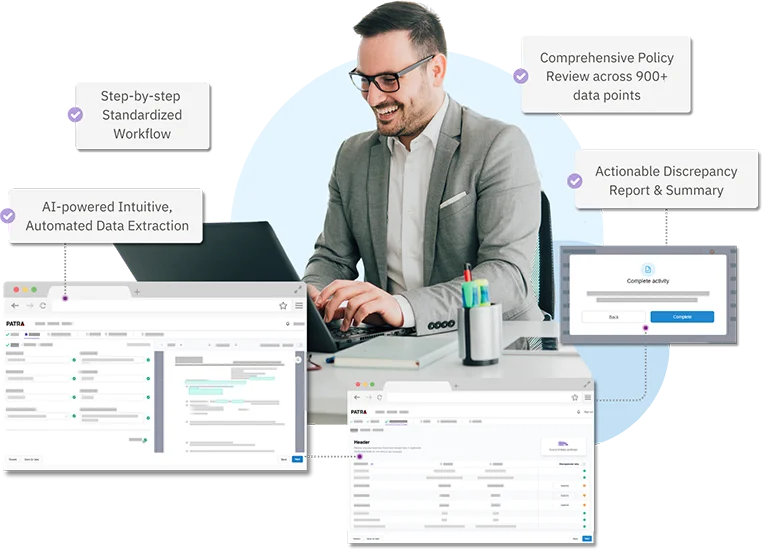

And most recently, we’ve been pushing out, and creating software, specifically AI powered software for policy checking and quote comparison for commercial lines.

That’s awesome. And I think as so I was a personal lines agent almost exclusively when I was in the insurance space. So I’ve learned so much about the commercial line space and the different pain points, that you just brought up with policy checking and then, you know, quote comparison, which could, of course, span both personal lines and commercial lines. So Yeah. From a from a producer standpoint or an agency principal standpoint, how easy is it to use those two solutions, guessing that they’re two of the biggest pain points that the agencies might, be experiencing that leads up to you?

Yeah. You know, for the longest time, us and those other providers out there that we’ve been, doing policy checking, basically taking that off of the agency’s hands. You know? It’s not but policy checking is required. You have to do it. It’s not glamorous.

As a former agent, you know you’re sitting in a at a table. We have stacks of policies, papers spread out all over the place, and you’re comparing, especially at renewal time, January and July peak seasons, looking at renewing policies to new policies and making sure coverages, endorsements, etcetera, are all the same. There’s If there are variances, you’ve got to check. Alright. Should we have to change this, etcetera?

You know, just going back, you made your personalized example. I have a personal auto policy. I have one driver and one vehicle itself.

My policy is ninety two pages just for one vehicle and one driver.

That’s just for one personal auto and we have a policy. Now imagine in the commercial world where you write a commercial package policy and somebody has hundreds of building locations all over the place, or you write a commercial automobile policy that’s a fleet policy, has thousands of fleets of vehicles. Imagine, like, UPS trucks, those things. So, it is a pain for people to do on a manual basis. And so Patrick, for the longest time, we would they would outsource that to us, and we would do that manual work for them.

And then we’ve heard more and more from our customers and from, prospects out in the agency and broker world that, is there software out there? Can we like, sometimes we wanna do these things ourselves in house, and we get you know what?

That’s a great idea. Let’s start working. So we developed software. We built our own large language model, and using our natural language processing and machine learning that we’ve built these tools over the years. It’s all housed up in our own private cloud.

And, we have software now that we, you know, sell to agencies and brokers, for we have nine commercial lines of business right now on it, both for policy checking and for quote comparison.

The neat thing is that if you don’t want that software in house, you can still outsource it to us. We’ll do it. But the nice thing is, unlike a lot of vendors out there, we’re actually using the same tech that we’re selling to you to perform that service for others that wanna outsource it. So for example, if you case that your agency said, you know what, Steve? I just don’t wanna deal with that stuff. You just do it. Okay?

That’s great. And I’ll do it as Patra, and I’ll check the policies for you. But rather than, charging an absorbent amount for all that manual labor that we normally would be doing in processing time, I’m gonna be using our own AI software that we’ve developed to run the policy checks through. I’ll look at, and see where the discrepancies are and then deliver it back to you.

Right? So we’re saving not only just the cost of doing business, but from the operational, standpoint. So that’s really what’s exciting up about what’s going on in policy checking and quote comparison too. Obviously, there’s a lot of tools out there for personal lines.

Really not a lot of stand alone quote comparison tools for the commercial line space.

So Gotcha. Gotcha. Well, I think, it’s a topic for a different discussion, but when you said, you know, you built your own large language model, I would like to know how one builds a large language model probably just for my own.

Yeah. That that is a long discussion that I would be happy to have with our CTO on the call who’s far more knowledgeable on the nuts and bolts of how that was done, but it it’s taken a number of years. We didn’t take shortcuts.

So we didn’t we didn’t build it off of generative AI, meaning, like, a Chat GPT or something like that. This something that we’ve homegrown with all of the twenty years of insurance expertise that we have and bringing in data scientists, etcetera, to be able to, you know, do that. You know, we’ve been processing, you know, insurance policies, millions and millions of policies over twenty of years. So, you know, we’ve got that business knowledge expertise, and we brought in the technology expertise.

And now we’re, you know, offering software to the industry because as a, you know, as a BPO provider, we can continue in doing what we’re doing, and it’s great. But we have to evolve a little bit too, and we have to keep up with demand of what not only our customers want, but what the market is looking for. And, you know, again, policy checking, it you have to do this. It’s a necessity.

And for some agencies, especially smaller ones, they’re uncomfortable maybe or leery about, you know, outsourcing it to a third party.

I’ve got software that you can do it yourself.

So now post policy check, whether that’s done by the agency wanting to use your software or sending it to you in in an outsourcing model, what do they get at the end of that process to show the analysis between the policies? Like, hey. We noticed x, y, and z are different or something’s missing.

Like, what does that kind of look like, and how are agents in Virginia?

Yeah. So there’s reporting on the variances that that if any variances show up between the, you know, the policy that you have versus and we and we check it against two source documents.

And so then there’s output that comes out there, and you can see what and it’s color coded. It tells you, like, you know, red. Obviously, there’s some variances here. We need to look at it. So if you’re the agent, you know right away, okay. I’m gonna look at these things. For us, we have the same thing.

You know, so that’s the output that they get, and that’s how they understand what’s going on. So before they can make any corrections that are necessary before they deliver anything over to their client, for example.

Gotcha. Gotcha. What other what other features or, outsourcing, you know, can Patra help an agency with outside of those, you know, two very specific but also super important, use cases?

Yeah. So, great question. You know, being in the industry twenty years, we do everything from front office and back office on the property and casualty, side of the business. So, we have services for, quoting, issuing, etcetera. On the back end, it’s all of the policy servicing that you can possibly imagine, you know, endorsements, renewals, those type of things, and goes along with the checking and everything else. So it’s really super nuts. We can actually be your own your extension of your own agency, you know, having your own virtual assistants, if you will, working with that.

So with quoting as an example then, so that’s something where there is a person, an employee at Patrick who’s going to actually go in and complete that quote and then, you know, send it back to the agencies, send it Right.

If they yeah. Exactly. If they wanted that, the nice thing with having the AI tool is now it’s software in house. So, you know, you’re just on your laptop, and you can do it right there and get it, you know, within minutes versus might take a couple hours between the output of going into, you know, sending it up into us and we review it and then send things back. So now you’re doing it and getting it, you know, in a couple of minutes, which is, you know, fantastic for the agent or the account manager who’s, you know, working on it because then the faster they get that back, the faster they get back to either their existing customer or prospect that they’re working with.

Right.

Help them close business faster as well.

Sure. Yeah. That’s the name of the game, right, is to be able to provide that service, that that quality, quote or, you know, whatever you’re working on. And the customer doesn’t feel anything different, but you were able to do as much of it as possible, as effectively as possible, you know, making better use of your time for sure.

So, well, we have a few more minutes left, and I wanted to ask, kind of pivoting a little bit away from Patra specific, but just in general. So I’ve been Yeah. On the road at a lot of agency events or rather, big events, and I know we just you mentioned before the call that you were recently at a at an, a vendor event. So when you’re talking to agents or for producers or agency owners out there in the wild, so to speak, I’ve noticed there’s a huge, you know, difference between some that are all in on technology and automation, outsourcing AI.

And there’s some that are using pencils and paper still, pen and paper, and filing cabinets. So kind of speaking more to that side of the spectrum, what kind of conversations are you having, or what kind of insights or advice do you have for an agency who feels that pressure to implement more technology but has anxiety about actually implementing the technology.

Yeah. No. That’s right. I mean, look, people still do business the old way, and for some people, that works out just fine.

You know, the challenge comes with trying to recruit in, the younger, the next generation. They’re they don’t wanna work on paper and pencil and so on. They want to do everything as they’re used to on their iPhone or on their laptop, whatever. They just, you know tech is their world.

And so we recognize that, and that’s what we’re talking to, agencies and brokers, especially when it comes into the software side.

That’s why we offer a special thirty day free trial offer of our software, both for policy checking and for quote compare. So you get up to thirty policy checks or thirty days or thirty quote comparisons or thirty days, whichever comes first, for free. No obligation. No credit card be required.

This where you could try it. You should be able to try something before you invest in it. And, you know, we’ve heard this from our existing customers and even from prospects that that’s great. You have software, but we’re a little bit hesitant.

Like, oh, kick the tires. I mean, you test drive a vehicle before you buy it. You should be able to do the same thing with software.

Oh, for sure.

Sort of, you know, like, ease that apprehension a little bit. And, you know, sometimes technology just isn’t for everybody. You know? It’s gonna take a learning curve.

And I think people get scared too. They feel it’s gonna replace them. You know? and we ran into this.

We were at the, NetVu Accelerate conference, and we’re on a panel discussion. And that was one of the questions that came up from the audience members. We’re like, you know, we’re worried it’s gonna AIs gonna replace our jobs. And, you know, our point of view is it’s not gonna replace, but it’s meant to enhance.

There’s always going to be that human in the loop, experience that’s needed for any kind of workflow in the insurance sector and in other areas well. But if you could use AI or other technologies to remove some of that mundane workload that you have to do on a day to day basis you know, if you’re an account manager if alright. Let’s say I’m your account manager. Okay.

You’re the owner. Do you wanna pay me to sit there and manually check policies, or do you wanna pay me to service our customers and get new business? I’m thinking the latter. And so if we can implement tech and or AI account or some combination of that, take care of that other stuff, and allow me to go do the things that are gonna bring revenue in to the agency and satisfy our customers, why would you not do that?

Oh, I agree. And that’s an that’s a concern I hear a lot, and I think it’s super valid. Right?

I think that people just don’t know, and so they want to have answers, and they have some anxiety about it. And I think that well, this kind of a weird thing, but it just popped into my head actually today. I was I was thinking about that I think the fear of technology and automation replacing humans is not like you said, it’s going to free up more time to do more human necessary things. But I do think that from an and I’ve thought about it from a agency standpoint more often than not, but something clicked today and I thought about it from, like, an employee standpoint.

If employees are listening to this, and I’m gonna make some content about this. Like, employees need to be focused on ways that they can embrace technology to make themselves more valuable versus the ones who buck the trend thinking if I don’t use this, it will protect my job. I think those are the ones who are at most risk.

That was a weird soapbox, but it was something No. It’s a like, today.

It’s a skill set like anything else. It’s another added skill, on your resume and in your business portfolio of things that you can do. You know, it just it’s gonna help you be more marketable.

You know, unfortunately, people, find themselves where they’re looking for new employment.

And imagine if you had that skill set now where, yes, I’ve used technologies. I’ve used certain things. Oh, okay. Just makes you that much more marketable and knowledgeable too. I mean, you always should be trying to learn new things and educate yourself and, you know, so, you know, I don’t at least not in my gender not my lifetime, I don’t see AI completely replacing human beings. You know, maybe fifty years down the road, who knows what’s gonna happen. But for now, in today’s day and age, it’s just going to enhance our lives.

And so I agree.

I agree. So speaking of that, that’s a great, topic to kind of focus on for the last couple minutes here is what are you excited about maybe that that Patra’s got in the pipeline that you can talk about, if it’s not you know, if I didn’t need to sign an NDA or something?

What can you tell us that that you’re excited about that’s being developed or that you expect might be available in the next, you know, year or two?

Yeah. Well, certainly, there are some things I can’t talk about, right, because we’re not, you know, for the listeners on that are gonna be on here, then we’re not under an DA with them. But, you know, we’ve got these two new software solutions.

You can bet that there will be more, forthcoming in different areas. You know, there could be areas like, you know, what are think of other pain points that people have.

Loss runs is another area where people might look at as sort of a manual pain point. That could be something that, you know, AI can use and automate.

You know, policy issuance, that part of it. That’s another piece of the puzzle here that could certainly, AI can, help advance that.

So, yeah, I think as we as Patrick grows and we turn and transform ourselves from, from a pure BPOs outsourcing services provider into a software provider, into the property and casualty space. That that’s really exciting for me. You know, we’re still we’re not abandoning what we’ve done. We’re still going to continue doing outsourcing services, but we have different, offerings now depending on what your appetite is.

Some people want software. Some people still just they look at certain things. They say, you know what? It’s not a value add for me to do it.

Let some but some other expert do it.

Gotcha. Absolutely. Well, I appreciate your time. I appreciate your insights, and I’m looking forward to seeing you down the road.

I’m sure our paths will cross at an event here in the near future and, also appreciate your partnership. I mean, what you all are doing for agencies is great, and we’re happy to be able to help, you know, spread the word, with what you’re doing with agencies. And, really look forward to continuing, continuing that relationship down the road, Steve.

Absolutely, Casey. Thank you very much for your time. I always appreciate the partnership that, Patra has with Battle dot net, and, I look forward to, future podcast discussions with you.

Awesome. Yes. One where you can teach me how to quickly and easily make a large language model of my own. Right?

Yeah. Will do. Sounds good, Casey.

Thanks, Steve. Have a good one.

You as well.