Addressing the unique challenges of MGAs and MGUs

MGAs and MGUs face specific operational challenges that generic technology solutions fail to address:

- Authority compliance monitoring across multiple programs and carriers

- Detailed underwriting documentation requirements

- Complex program management with diverse coverage forms and endorsements

- Carrier reporting demands require comprehensive data capture

- Balancing growth objectives with compliance requirements

As program business continues to expand, MGAs and MGUs that rely on manual processes and generic solutions will struggle to maintain compliance and manage delegated authority while achieving growth objectives.

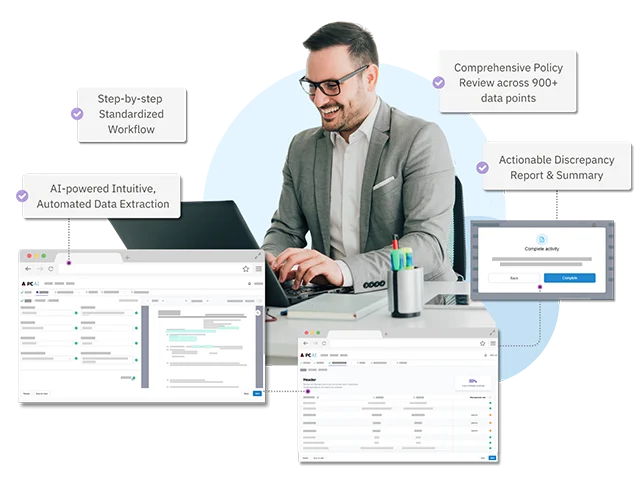

The Patra AI platform: Purpose-built for MGA/MGU operations

The Patra AI Platform represents a transformative approach to MGA/MGU operations, combining three powerful AI-powered solutions specifically designed for program business. Built on decades of insurance processing experience and trained on millions of insurance documents, the platform delivers unprecedented accuracy, efficiency, and scalability for delegated authority operations.

Quote Compare AI: Transform program growth

In program business, the ability to efficiently analyze and compare submission options directly impacts growth potential. Quote Compare AI modernizes this process by:

Automatically extracting and analyzing data from complex submission documents.

Creating standardized, professional comparisons across program options.

Delivering comprehensive coverage and premium analysis for program business.

Supporting specialized program forms and endorsements with precision.

MGAs and MGUs implementing Quote Compare AI for their insurance quote comparison needs have renovated their quote turnaround time by 70% while maintaining strict authority compliance, enabling program growth without proportional staff increases.

Policy Data Extract AI: Enhance carrier reporting

The data trapped in policy documents represents critical program intelligence needed for carrier reporting and program analysis. Policy Data Extract AI automatically extracts and structures this information with:

Industry-leading 99%+ accuracy.

Support for all major commercial lines and program business.

Comprehensive capture of policy details, coverages, limits, and exposures.

Structured output ready for carrier reporting and program analytics .

With structured, accessible policy data for data extraction, MGAs and MGUs can enhance carrier reporting, improve program performance analysis, and identify opportunities for program expansion.

Workstream flexibility: Adapt to program requirements

The recently enhanced Patra AI Platform now offers expanded workstream flexibility through multiple service options, enabling MGAs and MGUs to:

Enable multi-state program launches without proportional staff increases.

Seamlessly adapt to regulatory changes across jurisdictions.

Dynamically manage capacity during market fluctuations.

Choose the implementation model that best fits your program requirements.

For example, with Policy Checking AI, you can now choose from four flexible service options:

- AI-Only: Streamlined automation without human review for maximum efficiency

- Self-Service: Direct access to AI technology for in-house teams

- Full-Service: Comprehensive managed service with E&O coverage

- Custom: White-glove service with tailored workflows and reporting

Similarly, Quote Compare AI offers three distinct options (AI-Only, Self-Service, and Full-Service) to match your specific program requirements.

Customer success story: MGA program growth

A specialty MGA using the complete Patra AI suite accelerated their program growth while maintaining strict compliance:

Reduced quote turnaround time by 70%.

Grew program premium by 45% in six months.

Improved bind ratios by 25% .

Achieved 100% authority compliance through automated monitoring.

Enhanced carrier reporting with comprehensive program analytics.