Today’s direct mail systems produce sophisticated materials

While digitization and paperless technologies have revolutionized the insurance industry, paper still has its place. In fact, printing and direct mail continue to play a prominent role in insurance industry communications—and it’s far from “low-tech.” Today’s direct mail systems can produce sophisticated, highly customized materials and automate targeted campaigns that get results. Learn how direct mail, when it’s done well and with proper attention to security, can grow your insurance business.

There is a wide range of documents, of varying size and complexity, that you may want to produce as part of your multi-channel communications. They can include:

- Certificates

- Evidences

- Endorsements

- Letters

- Reports

- Policies

- Marketing materials

- Posters

- Branded internal documents

In addition to sending materials to your target audiences directly, you can make printed marketing materials available to your agents. It’s even possible to offer templates that agents can easily personalize and print on demand.

In 2019, the Small Business Administration declared, “Direct mail is hot again.” Many B2B and B2C industries are rediscovering the power of the medium, and insurance is no exception.

The Data and Marketing Association reports that more than 40% of direct mail recipients either read or scan the mail they get. Not only are your customers reading your mail, but they are also retaining what they read. One study showed that direct mail requires 21% less cognitive effort to process than digital media, suggesting that it is both easier to understand and more memorable. Brand recall was 70% higher among participants who were exposed to a direct mail piece than a digital one.

Integrate hard copy materials into a cross-channel effort by including augmented reality or QR codes to lead prospects to a personalized URL or video content.

Some industry professionals think of direct mail as a tool for life insurance only. In recent years, it has become more prominent for health and P&C insurance as well. According to market research firm Mintel Comperemedia, P&C insurance providers can mail more than 3.6 billion mailpieces in one year.

Health insurance is especially critical for direct mail because of the limited enrollment window: 70% of consumers reported direct mail as their preferred channel for receiving healthcare messaging, according to research by the ad agency LAVIDGE.

Printing and mailing in-house can take a lot of space, money, time and effort. By outsourcing this work, most insurance companies can:

- Save money on space and equipment

- Streamline workflows and focus on other tasks

- Get better quality printed materials

- Scale up operations

- Respond quickly to rate changes or widespread disasters

- Easily to track and measure results

When you send mail, you also gather important information through returned mail. An outsourced mail operation can scan each piece of returned mail and file the correct documentation within your management systems. They can also flag, correct, and remove or update addresses. These efforts help keep your database cleaner and increase your odds of reaching your intended audience.

Any industry knows that consumers expect more and more personalized communications from businesses. A study from the market research firm Epsilon found that 80% of consumers are more likely to do business with a company that provides a personalized brand experience. A whopping 90% say they find personalization appealing.

More than ever, insurance customers expect correspondence that’s tailored to them. Email and social advertising are often touted for their ability to speak directly to a narrow target audience and perhaps even address individuals by name. But don’t overlook direct mail as a form of personalized communication. Document software can fine tune names, policy types, policy numbers, and other details.

Having multiple personalized touch points in different mediums builds relationships, which can reduce churn. Take this approach a step further and automate to reach your audience at exactly the right moment in the customer journey.

The ability to succeed with hard copy documents and direct mail depends entirely on security. When you outsource these activities, you must be able to trust that your data is being handled securely and meeting compliance standards.

You will want to keep your customers’ information private at every step of the process. Some outsourcing firms will sell your customer lists if they don’t explicitly agree not to. Ensure that they have procedures in place to protect not only your customers’ contact information but also sensitive data contained within your correspondence—things like dates of birth, account number, income, type of vehicle, and health history.

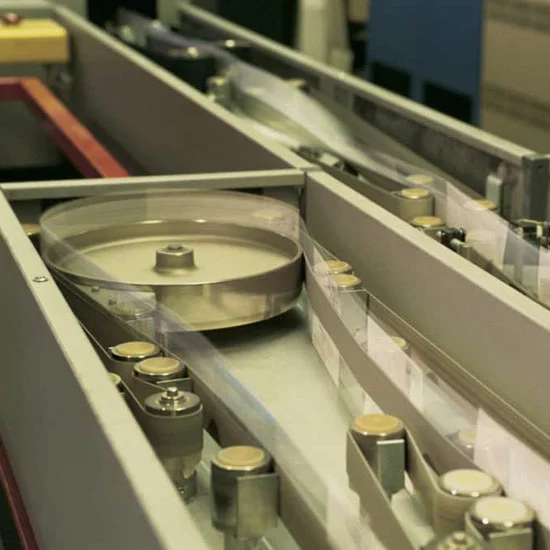

Patra offers full-service printing, mailing, scanning and document processing solutions for insurance businesses. Our Print Shop includes state-of-the-art mail-processing and printing technologies that can handle a variety of size, binding, and delivery options.

Our high-speed, high-capacity equipment and sophisticated shipping software reduce costs. You can also count on comprehensive security and quality procedures. Our promise is quality printed materials, delivered on time.

Whether you are a Patra customer already or not, we can connect with your systems and create document solutions that meet your business needs.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.