Exploring Opportunities to Unlock the Next Growth Phase

Managing General Agents (MGAs) and wholesalers are becoming increasingly relevant in the insurance ecosystem due to the unique advantages they have over brokers/agents. With five key transformation levers described in this blog, MGAs can overcome challenges and unlock a wave of unprecedented sustainable growth. Technology and business process services (BPS) providers can help MGSs reduce costs and increase their digitization and automation intensity. Read on to learn more.

The business model of MGAs stands apart from full-stack insurers and agents/brokers by the greater span of control and the profitability they generate. On the product side, MGAs have the flexibility to build products in collaboration with the insurer but may have a lower appetite for innovation and slower speed to market, depending on the insurer’s capability and commitment. On the customer relationship side, these specialized agents have full control over all customer activities.

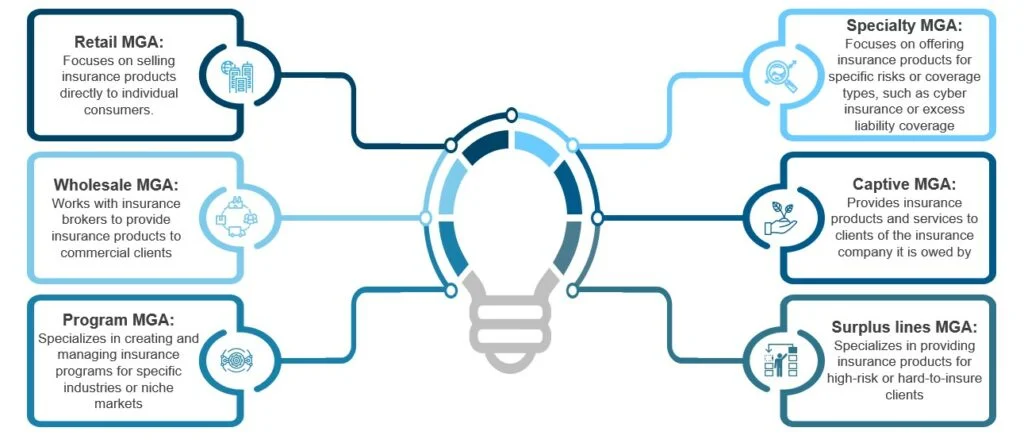

According to a McKinsey report, 43 percent of top 100 Property and Casualty (P&C) insurers have at least one MGA relationship to source new premiums. Various types of MGAs operating in the ecosystem are illustrated below:

Source: Everest Group

Despite the significance of their role, MGAs face the following challenges in running operations effectively:

-

Complying with regulations:

MGAs must keep up with the most recent rules and compliance standards because insurance regulation is always changing and is state-based. Penalties, fines, and legal repercussions may arise from breaking rules.

-

Attracting and retaining talent:

MGAs face hurdles in attracting and retaining skilled and experienced employees who can provide quality services to clients.

-

Managing risks:

On behalf of insurance companies, MGAs are in charge of risk management. This requires agents to have a thorough understanding of the insurance products being supplied, the underlying risks, and the potential effects of these risks on the organization.

-

Balancing client demands with profitability:

Client demands for new products, services, and coverage may not be aligned with the profitability goals of the MGA.

-

Staying competitive in a rapidly changing industry:

MGAs must stay abreast of advances in technology, goods, and services in the insurance sector to remain competitive.

-

Competing with increasing industry consolidation:

With large companies getting bigger, it is more difficult for other players to compete effectively.

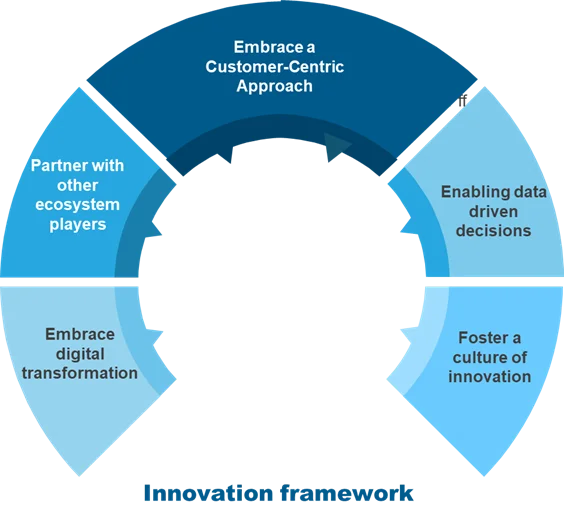

To remain competitive, MGAs must find new ways to transform their businesses by leveraging new technologies and business models, as shown below.

Source: Everest Group

Let’s explore each of the elements in the innovation framework in more detail:

-

Embrace digital transformation

MGAs can streamline operations, enhance customer experience, and cut costs by utilizing digital technologies, including automation, artificial intelligence, and cloud computing. To improve their decision-making and expand their business, MGAs can benefit from unique insights into consumer behavior and market trends provided by digital transformation.

-

Partner with other ecosystem providers

Partnering with insurtechs and technology and BPS providers is an effective way for MGAs to embrace digital transformation and wide-scale automation levers like Robotic Processing Automation (RPA), Artificial Intelligence/Machine Learning (AI/ML), Natural Language Processing (NLP), Optical Character Recognition (OCR), etc. By leveraging the expertise and technology of these providers, MGAs can access new tools and capabilities, helping them remain competitive and grow their business.

-

Embrace a customer-centric approach

Young customers prefer a digital-native approach and demand slick web and mobile interfaces to engage; direct-to-consumer (D2C) distribution platforms to buy; and two-way SMS messaging, chatbots, and interactive documents, forms, and videos to communicate. By offering these services, MGA insurance companies can not only improve customer satisfaction but also build deeper relationships with their customers, which can lead to increased loyalty and longer-term engagement.

-

Enable data-driven decision-making

Data and analytics play an increasingly important role in the insurance industry, and MGAs must leverage these tools to remain competitive. By collecting and analyzing data from multiple sources, such as customer interactions, market trends, and operational performance, MGAs can gain new insights into their business, enabling them to make more informed decisions and drive growth.

-

Foster a culture of innovation

Innovation is key to remaining competitive in the insurance industry, and MGAs must foster a culture of innovation to stay ahead of the curve. This requires a commitment to investing in new ideas and technologies, as well as encouraging employees to think creatively and embrace change.

These five transformation levers can help mitigate challenges like compliance adherence, talent management, low profitability, risk management, and strong competitive intensity by ensuring a culture of innovation, enforcing client-centricity, utilizing data analytics, outsourcing non-core functions, and embracing digitization.

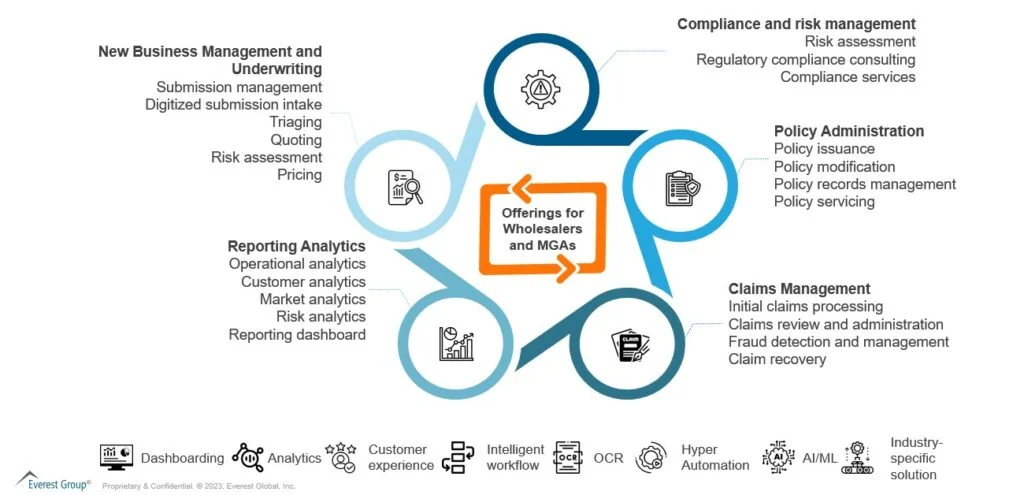

MGAs operate in an area requiring specialized knowledge and experience in specific insurance markets and products. Companies typically prefer to keep core functions in-house and outsource non-core traditional and technology-led activities.

Multiple tech and BPS service providers work across the ecosystem with insurers, agents, brokers, insurtechs, and MGAs that have built superior capabilities to provide services across multiple business lines and geographies.

Service providers also offer the latest tools and technology, superior customer experience capabilities, operational efficiency, Service Level Agreement (SLA) management, flexibility to ramp operations up and down, superior talent, a low-cost advantage, best-in-class lean operations, improved risk management, and much more. MGAs can outsource either a part of the value chain or engage in end-to-end transformative deals, depending on their appetite for outsourcing, process maturity, and management buy-in.

Some of the areas within MGA’s and wholesaler’s process value chain that can be outsourced are as follows:

Source: Everest Group

MGAs need to evaluate the service provider’s capabilities after carefully considering their expertise, experience, cost arbitrage, flexibility, security, business continuity, delivery footprint, talent maturity, technology, infrastructure, governance approach, and client-centricity.

Analyst firms like Everest Group can help evaluate these capabilities through its proprietary PEAK Matrix assessment and impartially rank the service providers as leaders, major contenders, and aspirants, as well as provide expert commentary to help enterprises make better-informed decisions.

To discuss MGAs in insurance and outsourcing trends, please reach out to suman.upardrasta@everestgrp.com and abhi.kothari@everestgrp.com, and stay updated by accessing our latest research on insurance business processes.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.