The challenge facing the entire insurance industry.

There are over 36,000 insurance brokerage firms representing $60 billion in annual revenue in the United States alone, yet many have struggled to scale. The insurance industry faces a conundrum: an increase in claims due to an aging population and other factors like natural disasters, plus a labor shortage caused by a “silver tsunami” of retiring professionals and fewer young people choosing careers in the sector. In other words, insurers have more work to do with fewer workers to do it – and that’s the problem Patra solves.

Launch From Original Source

Founded in 2005, Patra provides tech-enabled outsourced services to over 260 brokers, MGAs, wholesalers and carriers in North America.

At FTV, we have been investing in the insurtech sector for over 25 years. Most insurance professionals tell us they could grow faster if they weren’t so bogged down in all the time-intensive operational processes unique to their industry. Patra’s outsourced tech-enabled services streamline over a hundred different insurance operations tasks, including policy and certificate processing, accounting, billing, data entry, document management, mailings and more. With Patra handling all this administrative work, insurance entities can focus on generating new business, boosting renewals and uncovering new revenue streams.

FTV invested in Patra in September 2022, providing the company’s first outside capital. When we met Patra CEO and Co-founder John Simpson and his cohesive leadership team, we saw they truly understood the pain points in the insurance industry.

We recently sat down with Chief Financial Officer Simon Davis, who joined Patra in 2016. He told us how a customer-centric model, remote-only workforce and sustained tech investment have driven Patra to be profitable from day one.

Q: Patra got started in 2005. What problem did the company set out to solve nearly 20 years ago?

At the outset, Patra’s focus was simple and quite narrow: issue insurance certificates in the brokerage space. It was a time-consuming back-office task that no brokers liked doing, and Patra managed it very well. Inevitably our customers started asking: “What other administrative chores can you take off our plate?” And we responded. We have always been very customer-led, and so in the beginning our customers almost co-created our product offerings with us. They told us what they needed, and we built it.

Q: When you first looked for outside capital, Patra already had over 200 customers and was highly profitable. Why did you choose FTV as an investor at that time?

Many private equity companies reached out to us. Of all the firms we met, I most enjoyed speaking with the FTV team. They not only understood the insurance industry inside and out but had interesting insights into how to use technology to solve some of the most pressing problems in the sector. I could see FTV really appreciated what we had built and wanted us to succeed. Moreover, FTV’s Global Partner Network® was a unique draw. Since making its investment, FTV has proactively leveraged this network to help Patra by brokering introductions to dozens of customers, talent and partners.

Q: In the past four years, Patra has grown revenues over 200% with a net retention rate of 115% — meaning you don’t just retain customers, but they opt to purchase more services upon renewal. What is Patra’s secret to growing so fast while also keeping customers happy?

A lot of our success comes from our patient approach to growth. Since day one, we have used a “land and expand” approach to customer acquisition. In the early days, our founder did all the sales himself, and until 2017, we only had one sales person on staff. Now we have over 25 people on our sales team, but it’s still very high-touch. Once we’re embedded with our customers, we gain their trust and it snowballs from there. This only works if you have an outstanding product or service – so we also focus on delivering the best possible customer experience. In our sector, customers can be nervous about offshoring services, but once they start working with us, their fears melt away.

Q: How did Patra define its core value proposition, and what can founders still struggling to figure that out learn from your experience?

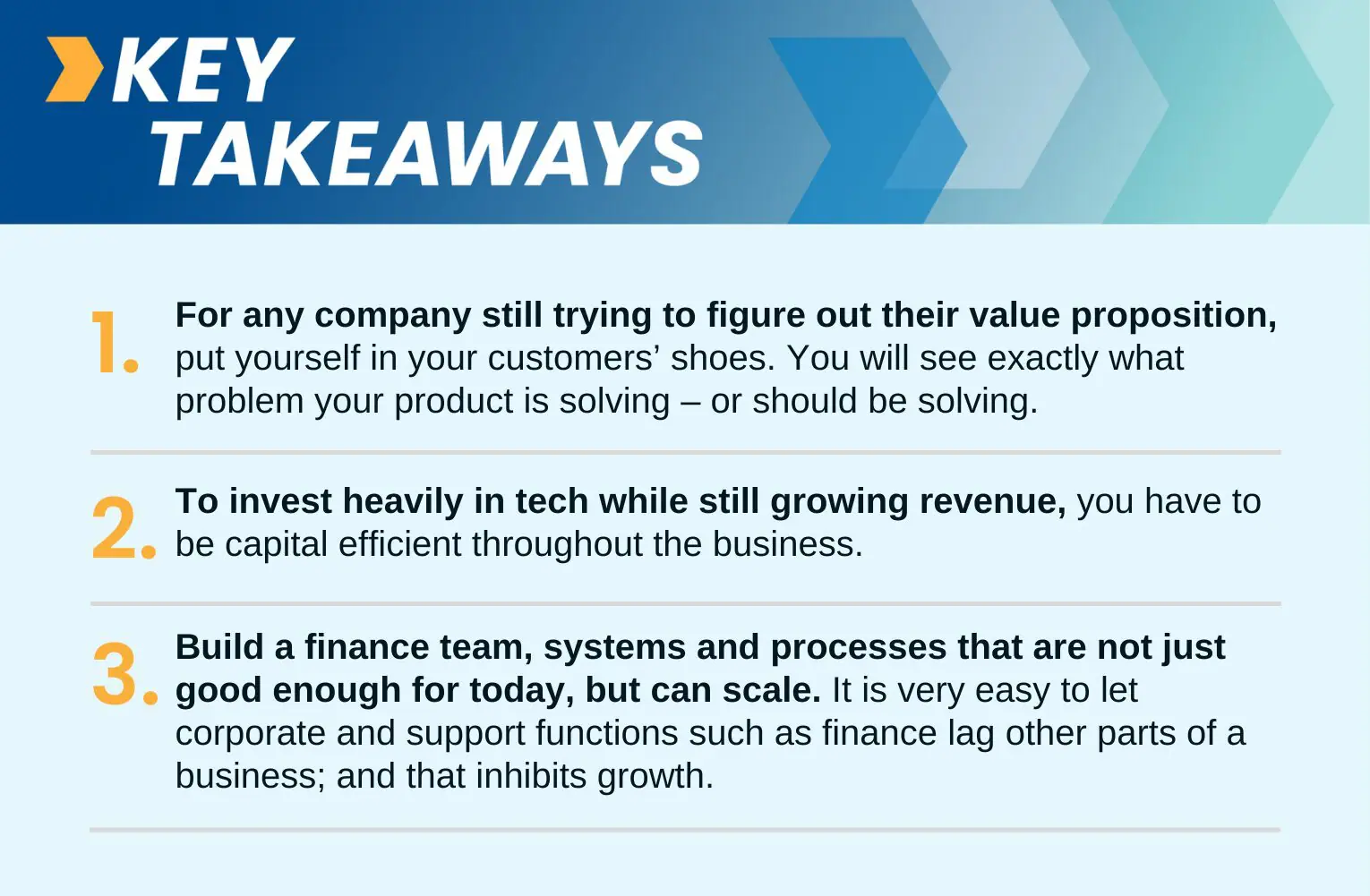

Our driving force every day is simple: eliminate our customers’ stress. Brokers love selling, but they usually don’t love the servicing part of the business. So our value proposition grew organically from solving an everyday problem. For our clients, we handle every aspect of the insurance policy and administrative lifecycle – from new business/marketing to policy servicing, renewal services and claims services to accounting and compliance needs – so they can focus on what they do best. For any company still trying to figure out their value proposition, put yourself in your customers’ shoes. Really live their lives for a week or a month. You will see exactly what problem your product is solving – or should be solving.

Q: What is one tip you can give entrepreneurs in terms of getting their financial houses in order to support hyper-growth?

When it comes to finance, think ahead. Build a finance team, systems and processes that are not just good enough for today, but can scale. It is very easy to let corporate and support functions such as finance lag other parts of a business; and that inhibits growth. Instead, think strategically a few years into the future so that collectively these functions are a valuable corporate asset that enables growth.

Q: Patra is known in the insurance services market as the leader in tech-driven solutions, including releasing the first-of-its-kind AI policy-checking product earlier this year. How has prioritizing tech investment helped Patra grow?

We invest much, much more in technology than our competitors. We built a proprietary internal platform that manages all of our workflows called PatraOne. That enables our employees to serve all our customers from a central hub, providing a seamless customer experience. We have a large in-house engineering team that’s especially focused on AI. We’ve touched hundreds of millions of insurance contracts and premiums, so we have a trove of valuable data on which to build ML models. We are building ML models for use in-house, and we are also building some tools we will soon be licensing to our customers on a SaaS basis. That is a new direction for us, but it’s an exciting part of our business.

Q: Patra has been profitable since day one. How do you balance profitable growth while also investing heavily in cutting-edge technology?

The trick is to only buy or build technology that solves a real customer problem, and to choose flexible offerings that can scale. To manage our engineering costs, we tap into the global talent pool. After all, we are an outsourcing company, so we practice what we preach: incredible talent exists everywhere. But to invest heavily in tech while still growing revenue, you have to be capital efficient throughout the business. Everything we do, we ask: “Does this investment help us generate more revenue, and can it scale to meet future growth?”

Q: What is one unique thing about Patra’s company culture that keeps employees coming back every day?

People come first at Patra, and we want our employees to have a great work-life balance. We are, and always have been, a remote-only company, with employees in all 50 states and in multiple countries. We were one of Zoom’s early adopters long before the pandemic! Because Patra is remote-only, we work extra hard to build connections that would happen more organically in a physical environment. We have excellent employee retention and are very proud of that.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.