Insurance policy checking automation through advanced technology

Patra’s insurance Policy Checking AI solution provides AI-centric workflows for users to automatically capture, compare, and validate policy data effortlessly.

Patra’s proprietary, patent-pending technology and comprehensive policy checklists, Policy Checking AI sets a new bar for checking policies with unsurpassed quality, accuracy, and efficiency.

Policy Checking AI advanced automation

Patent-pending technology

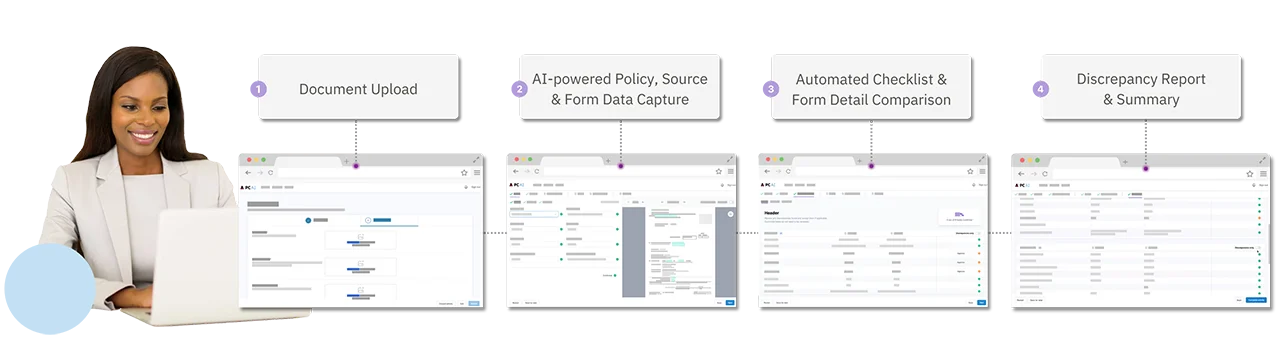

Intuitive data extraction via patent-pending AI/ML technology

Standardized workflow

Step-by-step workflow delivers consistent, high-quality output

Comprehensive policy review

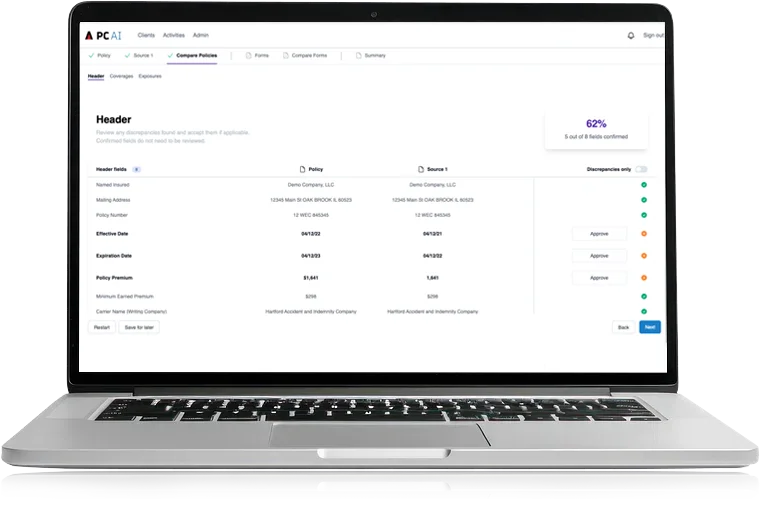

Detailed review of policy header, coverage and limits, exposures and form schedules

Discrepancy report & summary

Color-coded report for easy review, research and reporting

checked policies

elimination

manual processing

Connect with our insurance professionals

Our team of experts can help across all facets of the insurance market and operations. Learn how Policy Checking AI can power your business into the future.

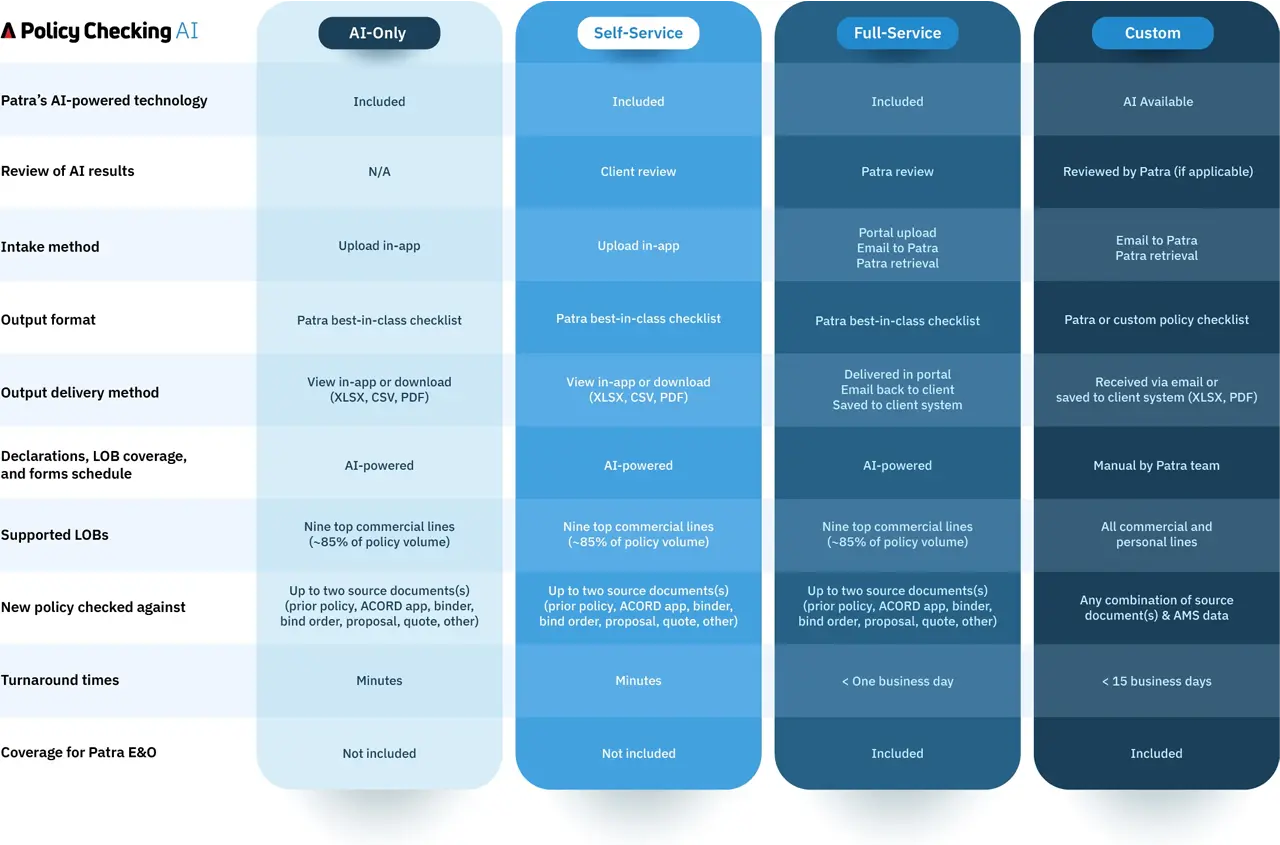

With Policy Checking AI, you have choices!

Our patent process prioritizes accuracy and completeness while reducing rework and review time for retail agencies and brokers, wholesalers, and MGAs/MGUs. Leveraging Patra’s 900+ point checklist, discrepancies are quickly identified and shared via a color-coded error report summary for account managers to easily scan and assess.

AI-Only

AI technology checks policies and provides output without human review from Patra. This streamlined option delivers rapid policy verification through sophisticated AI algorithms that extract, analyze, and compare policy data with exceptional accuracy. Best for organizations seeking to accelerate policy checking while maintaining internal oversight of the review process.

Self-Service

For organizations that prefer to handle this work internally, teams can now leverage the power of Policy Checking AI in-house. Patra’s self-service solution has transformed the practice of checking policies, providing the most sophisticated AI-based automation available on the market, enabling in-house teams to check policies with unparalleled speed and accuracy. The intuitive, user-friendly workflow excels at extracting, comparing, and highlighting inaccuracies and discrepancies between multiple versions of a policy.

Full-Service

Patra’s insurance professionals provide their final oversight leveraging AI-powered technology. This solution combines industry-leading Policy Checking AI technology with a dedicated team of processing executives assigned to your business. Patra experts can manage every aspect of the process if you choose, from retrieving policy documents to meticulously comparing results against your Agency Management System (AMS), updating your AMS, and delivering verified policies on your behalf. Patra also assumes the E&O risk associated with checking these policies.

Custom

Patra’s insurance professionals manage the entire policy checking process with tailored workflows designed specifically for your organization’s unique requirements. This white-glove service delivers comprehensive policy verification with customized quality control measures, reporting, and service level agreements to perfectly align with your operational needs and client expectations. Patra also assumes the E&O risk associated with checking these policies.

Policy Checking AI workflow process for insurance policy checking

Policy Checking AI options enable workstream flexibility

Patra offers workstream flexibility for its Policy Checking AI solutions ranging from an AI-automated process to a customized, white-glove service with human oversight.

These solutions provide insurance organizations flexibility to either leverage AI technology independently or benefit from Patra’s insurance professionals who can manage the entire process while assuming E&O risk for verified policies.

Frequently asked questions

The types of PDF documents include an Acord App, Binder, Bind Order, Prior Policy, Proposal, Quotes, and other related insurance documents.

Patra has purpose-built, insurance-specific AI workflows and capabilities to extract and compare insurance data from unstructured sources. This goes far beyond “AI-based chatbots”, no prompts required. Policy Checking AI includes a comprehensive 900+ point checklist that thoroughly examines policies to identify discrepancies. The results are presented via intuitive color-coded error report summaries, making it easy to quickly spot and address any issues.

No. We have found that our approach scales across thousands of document variances regardless of carriers/lines of business. RPA (“bots”) cannot scale to solve for data extraction in complex insurance documents.

Policy Checking AI supports nine major commercial insurance lines of business, representing approximately 85% of premium volume in the commercial insurance market including BOP/CPP, Commercial Automobile, Commercial General Liability, Commercial Property, Commercial Umbrella, Cyber Liability, Excess Liability, Professional Liability, and Workers Compensation.

Currently, the data is delivered in CSV format to start. JSON and API options are coming soon, providing greater flexibility in how you can integrate and utilize the policy checking results within your existing systems.

Ready to experience the Policy Checking AI advantage?

Let's get moving! Contact us today to learn more about Patra's state of the art solution for checking policies.