Retail agencies, brokers, wholesalers, and MGAs gain advantage with AI

The push for AI innovation

Essential AI solutions

Real-world results

Boost Efficiency with AI

Alright. We’re at 11:02. It looks like we’ve got a pretty sizable crowd with us. I’m gonna go ahead and get things kicked off for us. Again, I wanna thank all of you for joining us today and spending some time with us. Our goal here for you today at Patria is we wanna help cut through the hype and share with you some real world AI solutions, that are readily available for you to be using today. Today, we’ll be talking about solutions that are viable, accessible, easy for you to use, but also shedding some light on AI itself.

So with that, I just wanna do a quick introduction to our host here. My name is Brian Smith. I’m the manager of new business development here at Patra. I’ve got about twenty years of experience selling technology, software in the insurance space as well.

I work with agencies on a daily basis, helping uncover solutions for them, not only utilizing technology and AI, but also in more of the traditional, outsourcing services. I am joined here today by Brett Cleveringa. Brett’s our vice president of product. Brett, if you wanna give a quick introduction.

Thanks, Brian. Hey, everyone. Brett Cleveringa. As Brian mentioned, I lead I lead a lot of our product efforts here at Patra. Been in the insurance space my entire career. Used to sell commercial lines a long time ago. Somehow found my way into product and have done a few different things at, a couple of InsurTechs over the years.

I’ve been at Vertivore in a couple product roles and, spent some time in some startups as well before joining Patra. And, I’m excited to talk to you about technology, AI, and all things, insurance here today.

Excellent. Thanks, Brett. So just a quick look at the agenda here for the time we’ll spend. We’ll probably be together next forty five to fifty five minutes.

Give you a little light around AI and an introduction. Right? I think one of the things that we’ve noticed, and you’re noticing this as well, you can’t walk out your front door without being clobbered over the head with AI in one sense or another. We really wanna spend some time with you today kind of bringing some clarity to that, demystifying what AI is.

Is it going to replace my job? Am I going to be replaced by AI? We don’t think that’s the case, so we’re gonna talk a little bit about AI and how it’s being used in insurance. We’ll also share a little bit about Patra’s approach to AI, how we’ve developed the products and services that we have available utilizing AI.

Brett’s gonna spend a little time actually showing us a real world use case. We can see the technology, the ease of use, and the outputs that we get. And then as a last step here, we’ll share some special offers that are available for you for joining us as a thank you for your time.

So as we dive into this, a real quick, again, look at the presentation today. I wanna start off just first of all, kind of with a demystification, if I can, of AI.

I know it can be a scary thing, and a lot of us here are not experts in AI nor do we expect you to be. I like to look at AI if you’re familiar with any superheroes, and I’ve got a eight year old son at home, so we do a lot of superhero movies here. Iron Man comes to mind as a great way to help explain AI. Iron Man puts on this suit that gives him these superpowers. He can fly and shoot lasers and X-ray vision, but the man himself is still inside of that suit commanding that technology.

I like to liken AI to that suit. It’s the tools and the solutions that give me, the end user, the ability to be more efficient, to reduce my cost, to simplify some of the time consuming long processes that we’re doing and free me up and give me the ability to spend more time in front of the insured, prospecting, growing my business, servicing, etcetera. So as we go through this today, kind of keep in mind, right, AI shouldn’t be the scary thing. It It should be the suit that’s gonna give us a superpower.

When we look at AI, we’re looking really from a beginning to end solution. Again, that helps deliver measurable results.

A lot of the times, what we’re doing is a manual drawn out process.

Sometimes we skip that because we don’t have the time, the energy, or the effort to do that. We can give you tools to help reduce that time, make things more efficient. It’s very flexible in terms of our end users. Every end user we work with, whether you’re a retail agency, a carrier, a wholesaler, a broker, you all have a little bit different needs. We have solutions utilizing AI and that technology to help you in your particular business and your particular needs.

And I think the most important thing and one of the things to me that’s really neat about AI and the technology, look back thirty years ago with this data. We’ve had this data in our hands forever, but it was flat. It was files and file cabinets in our offices and file folders on our desks, and we had to manually manipulate that.

We move forward, you know, twenty, thirty years. Now we have the same information and it’s on the cloud. Still relatively flat, little more easy to access, But with the use of AI for the first time ever, we’re able to bring that to life and put life behind that and give it to you in something that you can extract and you can engage with through the use of business intelligence tools, through the use of our data analyst, and really come up with a solid solution and a plan for what we need to use this data for to guide our business, whether it’s to understand our customers better, any m and a’s that we might be looking at, or just an overall understanding of where the marketplace is headed. So keeping that in mind today, I wanna intro let Brett come in here and talk a little bit as a primer, little introduction to AI, the different types of AI, and the applications and uses that we see for it within the insurance space.

Thanks, Brian.

Love a little virtual show of hands by anyone if you’re willing to. If maybe you are using various AI tools, in your daily business today, There’s a lot of generic AI tools out there that can really help just make everyone’s lives easier as a a business professional. Right? Summarize emails, get questions answered really quickly, all those other things.

So if you’ve if you have been exploring various AI tools in your daily, daily job, that’s great. If you’ve not, certainly would encourage that. Go ahead and try some things out, see what you can figure out.

What I wanna do today before we dive into our specific solutions and our view on AI is do just a little bit of education. So we’ve got a couple slides here. We’ll talk through a few details, around what AI is for those that maybe haven’t tried or aren’t as aware. Maybe sounds a little scary as a topic. I think what you’re gonna hear from us today is there’s no reason to be scared or afraid of AI and what it can do, but our belief is really there’s a lot of tools out there that really can help all of us perform our jobs better, and we’ll hear a little bit more about that today.

Before we get into that, just wanna provide a little bit of context and some different definitions and terms, and things that, you may be hearing and are wondering. I don’t know what these are. I’m not the most technical person. What does this information mean? So a few things we’ve got called out, I’ll say.

My guess is that most of the group has probably heard of Chad GPT or OpenAI, maybe Microsoft Copilot, Claude, other different terms.

What I will say, we’re gonna get into a little bit of detail here. I’ve got just four terms that are a little bit specific about different types of AI that are commonly used, in technology today to enable some of those experiences that you maybe have seen elsewhere, enable, within our own solution suite, as well.

Few four key areas I’m just gonna focus on, machine learning, natural language processing or NLP, LLM, large language models, and Agentic AI. Machine learning, think of it really about, just analyzing data, making predictions, you know, a machine’s ability to learn over time. We’ve got natural language processing, being able to understand human language. Right?

Allowing a computer to understand human language, whether that’s, you know, voice or things that are written out in documents, etcetera. And then large language model, this is maybe something that if you’ve used ChatGPT or Copilot or other tools, to do various things, a lot of these, you’ll hear a lot of noise about that from an AI standpoint. Think of that as more of an LLM based solution. Right?

If you’re using a chatbot, you’re getting questions answered. If you’re, getting an email summarized or maybe you say, hey. I need help, writing an email and generating some content. That’s a lot of the functionality that’s behind the scenes, allowing you to do that.

And one that’s a newer term that’s getting a lot of noise, excitement, and traction is something called agentic AI, which is really AI to really think about full autonomy in the future. Right? That’s a call I’ll make there. So these are a few different, key terms.

Just wanna provide a little bit of education about this. At the end of the day, you know, artificial intelligence really just, you know, machine or computer’s ability to perform more like what a human would, or allow us to kind of speed up or, do things, using computers just like human brain function, can do today.

Let’s talk a little bit about what this means for the insurance space.

So we’re gonna go a little bit of history, talk about what’s happening right now, and then we’re also gonna get into what’s next. What can we expect?

What’s happening today that’s maybe gonna enable things six months, a year from now as well?

So let’s talk about the past. And this is more, I’d say, over the last, you know, five, six, seven, eight years, AI has gotten more and more traction. Really, where AI probably was first involved in the insurance space is around intelligent data extraction or, intelligent data processing. Couple of different terms there.

What does that really mean? Really just means, you know, machine learning based extraction of data. Think about documents. We got documents everywhere in the insurance space.

How do we get data out of documents is really a good example for what, you know, intelligent data extraction is. It’s not comprehensive. It doesn’t automate all processes ever, and it relies on human review, hundred percent. You may hear a term called human in the loop.

Data extraction certainly has traditionally required a lot of human in the loop processing.

That’s where we’ve been. Where are we at today? Well, today, we’re getting into more of what would be referred to as, or you start to hear, Agentic AI. Where we’re at right now is really in this world where AI is getting embedded in various technology applications to provide more of an agentic workflow experience.

Take some of the best things about AI, combine that with the ability of a human, and you can analyze different work different documents or data. You can perform things at hyper speed compared to what, you know, you or I would maybe have done ten years ago, having to read documents, interpret, make decisions, enter data. We now have a lot of AI based solutions that are out there that allow us to really perform at hyper speed. Right? You think about Brian’s analogy he just had.

This is really getting to a world where maybe everyone gets an Ironman suit to do things like policy checking and quote compare and other different activities.

It’s not fully automated. It’s not a hundred percent accurate without a human potentially having, the ability to oversee, go faster, but make final decisions.

I bring this present up because there’s a lot of opportunity to gain efficiencies, speed, and do things better just with where we’re already at today using AI, and we’re gonna show you some of those examples, in a little bit later today as well.

Now where are we gonna go? Where are things headed in the future? There is a lot of hype and a lot of noise right now about AI agents out in market. If you’ve seen, Salesforce, commercial with Matthew McConaughey, if you’ve seen ServiceNow advertising, a lot of excitement about Agentic AI.

Agentic AI or an AI agent doing an end to end workflow autonomous autonomously by itself. That’s really the end goal. Right? Take a workflow one hundred percent end to end processing, fully automated, no human intervention.

That’s the vision behind what you hear as AI agents. What I can tell you is we’re not quite there just yet with the current technology that’s out there. We’re more in that agentic workflow space today. But in the future, there’s a lot of opportunity for different workflows to eventually become more and more fully autonomous.

As AI gets better and better, as, you know, the infrastructure and the core technology gets there over time, there are certainly workflows that may get to that space where an AI agent can really take things end to end.

Just wanna make that piece clear. Provide a little bit more color and context around where we’ve been, where things are at today from a technology standpoint. There’s a lot of hype about this future state, and we may get there with certain workflows. But really just wanna, you know, educate a little bit of where we’re at today versus what may be coming in the future. Certain things may not quite get there, but, we’re excited to see know, we do this all the time at Patra. We do a lot of experimentation. Really excited to see where things are going, from an AI agent standpoint.

And some things are certainly gonna prove out to be, feasible, and there may be other workflows that, you know, we may be in that agentic workflow space for a little while as well.

Okay.

Now we gave a little bit of education where we’re at. Wanna provide some more context. But what we’re doing at Patra, how we view AI specifically, and then, we’ll hand things off here eventually to Brian to get into some of our, solutions as well.

So our viewpoint on AI mentioned that agentic workflow space where we’re at right now from a present standpoint.

Within that, we’ve been investing pretty heavily at Patra, for the last few years on our various AI capabilities.

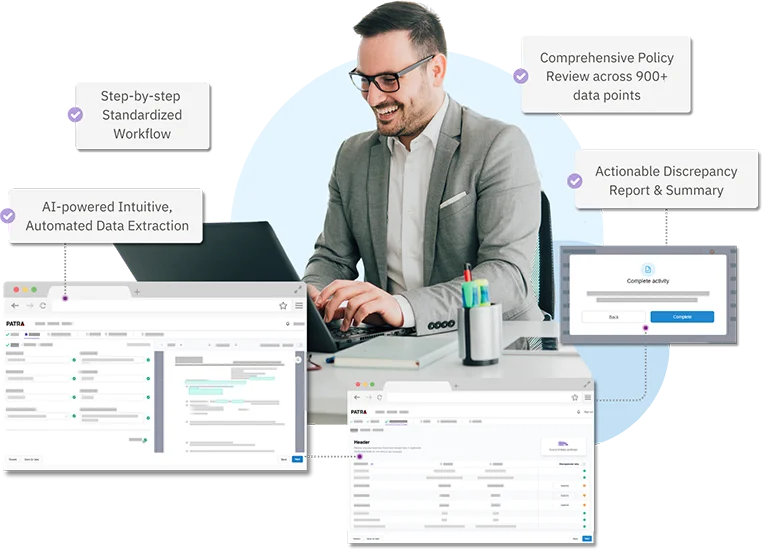

We now have a solution suite we refer to here as Patra AI, which is a growing suite of solutions that’s purpose built for the insurance industry.

We have a lot of document heavy workflows that require data extraction, which we’ve mentioned. They also require human review, which is ripe for some of the agentic workflows, as well.

So we have deployed and we have launched multiple solutions under our Patra AI suite, specifically targeted at key workflows in the insurance space. Things like policy checking, we’ll compare, structured policy data. Those solutions are all live and in production that we’ve launched over the last couple of years.

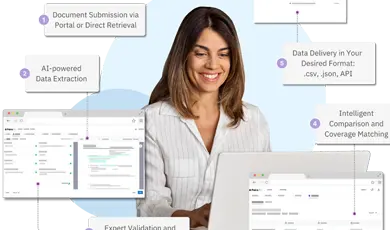

We believe in the future, taking a lot of the same technology and applying it to additional, solutions, things like certs or loss runs, applications, statement of values, lot of opportunity to continue expand, into additional use cases and services, within our space. What we’ve been able to see from our standpoint is that we can take a lot of the, real in production functionality that exists with AI, and we can embed it into our solutions in a few different ways, either through software as a service or a service delivery model, where we can have rapid turnaround times, really nice concise transactional pricing, and provide really multiple choice options available to our customers, which you’re gonna hear about in a little bit around our work stream flexibility capabilities.

Little bit more context on how we’ve gotten to where we’re at and where we’re heading from an AI standpoint. So I mentioned these three areas. Right? Intelligent data extract, kind of the past, agentic workflows, and then the future around AI agents.

Patra has been investing heavily in AI for the last, four or five years at this point.

A lot of focus on building out our data science team, exploring what is possible from an AI standpoint, and then launching solutions that solve real problems in the insurance space today.

We got started in 2022 with our first iteration of Patra AI pushing solutions in production, and we launched our policy checking AI full service solution, in 2022, brought it to market more broadly in 2023. Since then, we’ve kept going. We’ve expanded our solution suite. In 2024, we moved into the agentic workflow space.

We’ve brought to market, a self-service solution for policy checking that agencies can use themselves today in addition to Patra doing some of that work for you. We also have full service solutions for co compare and policy data extract that were launched in 2024, and we continue to expand this year as well. Our co compare solution is now available as a self-service offering. I mentioned work stream flexibility.

We’ll get into that in a little bit. And we’re gonna continue investing and building out additional solutions in the future as well, especially getting more towards that AI agent space as that technology becomes more real and usable in the future as well.

It’s a little bit of our path. Let’s talk about this work stream flexibility concept.

What we’ve been able to do is enable different flexible workflows now using technology so that we can bring our solutions to market and meet our customers wherever they may be, in their process.

We have a number of different solutions in our Patra AI suite, all of which can be enabled in four different ways, through just an AI only, more of a straight through processing solution. If there’s a risk tolerance and a comfort level to just rely on what AI can do and get an output, we’ve got that solution available. We also have our self-service solutions, which allow you to leverage our technology. So we talk about the assisted workflows. You take our tech, take our solution, and use it yourself, to perform various tasks much faster than you ever could before.

Also, we have full service solutions using this. So you can combine our technology plus Patra’s, people and our services to be able to provide you, a full service solution, take work completely off your plate, and get a combination of technology, and people. And if, you know, there’s certain areas where you need a fully customized solution, we also have that available, as well. So we now have four different offerings around these workflows and these solutions that we can give our customers.

What does an example look like? Let’s take policy checking as an example. It’s something we showed as being something that we had we’ve had now for a few years. If we take the old way of doing policy checking, some one of the things I did fifteen years ago in the insurance space, trying to review multiple documents.

Maybe you’ve got a renewal policy. Maybe you’ve got an expiring policy. Maybe you’ve got data in your AMS, and you’re reading and interpreting this. You’re walking through or scrolling through fifty, sixty, eighty, three hundred page policies sometimes.

And you’re trying to articulate this information and see what potentially has changed year to year, what’s different than maybe what was quoted, do I have any E&O risk, and you’re trying to find all that information so you can provide the best solution to your insured and also mitigate the E&O risk for your agency.

That process, if you’re doing a really thorough check, you’re looking at coverages, exposures, policy forms can often take anywhere from sixty to ninety minutes. Well, using our policy checking AI solution, we now have that workflow, that AI assisted experience for a user to go through to take that same policy checking process, and we can perform that now in five to ten minutes.

Using AI, using human interaction in the workflow to get to a one hundred percent accuracy, solution as well, and really reduce our cost, reduce our expense, and our time having to read manual, read documents manually by ourselves.

Okay. I think we’re gonna go back to Brian for a little bit. You’ll hear from me, in a few though, again as well.

Thanks a lot, Brett. Appreciate it. So, hopefully, we have a little better understanding and a little less fear around AI, right, based on what Brett had just shared with us. Brett mentioned briefly that our policy checking solutions. I wanna spend just a couple of minutes talking about what Patra has available today. Again, these products, these solutions that we’ve developed, we’ve been using these internally for over the last five years. We also have rolled these out to other agencies like yours, other carriers, wholesalers, etcetera, utilizing this technology.

These are a viable product that are tried and tested today. I, again, will start with policy checking as our first product for service here. Just a quick overview about this product and service. Right?

As we mentioned earlier in the in the presentation here today, we’ve utilized machine learning and AI and trained our platforms what to look for, what data you need to extract. So, again, you don’t need to be an expert in AI. We don’t need to be experts in prompting and understanding what we need to look for. Our platforms have been trained against a nine hundred plus point, checklist that each and every policy is going to go through automatically on your behalf.

We’re gonna capture, compare, and validate data in an effortless way.

If you do not want to be involved, we’ve got our AI only solution. If you want a little more hands on, a little more verification, that’s where our self-service model comes in. And lastly, as Brett just talked about, we don’t ever wanna touch this again. We’re going full service. Patra’s team is going to handle the document retrieval, the check, and the and the sending out of that summary report on our behalf.

Multiple formats are available in this, and what we’ve seen from our current users in this, heard this a few times, and I think we’ll continue to hear this as the nature of AI. We’re able to reduce the amount of time your teams and staff members are spending doing these types of tasks.

That automatically leads to a reduction in cost. We’re able to capture a little more revenue from each one of these policies that we have because we’re not spending as much time hands on in these processes.

Big thing that we’re also noticing is that reduction in that risk of E&O exposure.

Particularly if Patra is the one doing this for you through our full service model, we are fully covered on that E&O. Our teams are doing the processing, the review, and sending the work back. You’ve got some protections added protections there with Patra.

If you keep it in house, your team just has the satisfaction of knowing human fatigue didn’t set in, I didn’t get distracted, I didn’t skip over, AI knows its job. It’s gonna do it a hundred percent of the time accurately for you.

We also wanna take a look at our quote comparison AI. Quote compare AI is very similar in nature. Brett’s gonna give us a demonstration here in a moment of the technology here. Similar portal, similar process to get us started. And, again, AI is doing ninety percent of the work for us, if not a hundred percent in some of these cases.

Clear, concise, comprehensive, side by side analysis that we can use to make recommendations.

I think one of the keys here for our quote comparison, we know how time consuming preparing those quotes can be. If it’s a new policy, right, that time is money. We need to get back to these folks as quickly as they can before the folks down the road do. Time savings is here for you, a faster delivery output for you, that less risk exposure, not reduction, less risk exposure, and that positive ROI. You’re able to see this in a relatively quick manner through our quote compare AI tools.

As I mentioned earlier, another kind of byproduct almost, if you will, of the AI policy checking and quote comparison portal is the ability for us to go in and do some data extract. Again, bringing that data to life and giving it into a giving it back to you in a format in which is usable now. You can take this data, unstructured data. We can actually help you come up with some plans around how you anticipate using this data, give you that data back in a usable way accessible to not only your data analysts, but also for use within your BI tools.

Helping you again, agencies that are using this today, they’re making informed decisions, not only about the types of coverages they have, but learning more about their agencies and about their clients. From an m and a standpoint, this is a great tool to really help with that evaluation and understand accurately what the data mix you have is and how we can present this going further.

So you can see a lot of what we’re talking about here with AI is really based around accuracy, less time spent on these processes. Right? More time for you and your teams to be client facing, to spend time doing what we consider to be those high value tasks.

So with that, I think this is a great place for us to say, hey, Brett. We’ve talked about this a lot. Let’s show everybody what we’re referring to when we’re talking about our AI.

Fantastic. Thanks, Brian.

Just giving you the ability to share, Brett.

Got it.

Okay, everyone. We’ve done quite a bit of talking. Let’s do a little bit of show here as well.

Just confirming, Brian, everyone, and I’m assuming, Brian, you can see my screen, so we should be good.

So You’re all set. Yep.

Perfect. Alright.

Okay, everyone. So this is our this is our Patra AI, solution.

Couple things you’ll notice. I’m in the context of an existing customer already or, demo insured here. You’ll notice, again, we hit on a couple of our solutions. We hit on policy checking.

We hit on quote compare. That’s exactly we’re gonna walk through. It’s got something teed up here for both that we will show you. What I’ve already gone ahead and done is I’ve already gone ahead, and uploaded, the documents that I want to check.

How our solution works, upload the documents. It takes about a minute, minute and a half to process documents. And then as you see, I’ve got a couple of notifications here, telling me that I have documents that are ready to go, and I can see that these are in progress, that our AI has already started working on it. And we’ll get a look and feel for what we’ve actually extracted, what we’ve automatically compared, and then our user experience to validate, this as well.

So I’m just gonna hit continue and get into this workflow. And what you’re gonna see happen is I’m gonna get dropped right into our summary view. Our summary view here is gonna automatically show me everything that has been extracted from our using our AI extracted from these documents, and then also auto compared for me as well. It’s showing me exactly what we found. Now maybe there’s some discrepancies here that I wanna dig in a little bit further to, but it’s summarizing and showing me all the structured data and all the information that’s necessary for me to be able to perform a policy check.

This example happens to be a workers’ comp policy. So I can see I’ve got a workers’ comp policy here. From a check standpoint, I had three documents that were being used. And my my renewal policy in this case, I had a prior policy or expiring policy. And then also, I did this using an Accord app, because I wanted to see, maybe existing data that sits in my AMS. So, you know, exporting in the Chord app, being able to run that through our AI as well and compare this data and this information.

So if I take a look, I’m getting a nice summary of the information. I’m seeing policy header information or deck page data shown to me. I already see I’ve got a few discrepancies that I may wanna dig into in a little bit. I’ve also got my coverage information. Right? I’ve seen workers’ comp coverage detail that’s been extracted, entity types, waiver subrogation, coverage limits, all that information.

Also, my exposure set has been ex classified for me as well compared across all three of these documents. I’m seeing all of the various exposures I have here as well.

One thing that maybe pops out to me right away, if I just look at this, I was going through exposures, and I and I noticed that I’ve got a class code here that’s not showing me any payroll. I’ve got just a dash here. I wanna dig into that data maybe a little bit further and see what’s going on. I’m gonna navigate to my policy, and I can get into my exposure set here.

You can see now, this is what makes our solution unique. I can see all of the data that’s been extracted. This is not just about a summarization that maybe I get through a tool like chat GPT or something like that, but I actually can validate I can use the AI in my workflow to do an additional human review. And the first thing that I can very clearly see is if I navigate to this, outside sales class code and work comp, you know, our model, which performs really high, missed one thing, missed a payroll.

I can also interact, and I can capture this information as well.

From there, once I’ve got a full understanding of the data, I can go between every single document.

Information extracted across, the Accord application in this case.

If I wanna dig in deeper, right, as I click in, it’s gonna take me exactly where we found the information, and I’ll have a nice bounding box that I can validate. Yep. Patra’s AI model extracted this information correctly. This is looking great.

I’m going to my coverage information, right, coverage models, showing you some of the nuance and some of the detail that we have in our data models.

Brian had showed and talked about, our coverage points, our checklist, how deep we go from a data standpoint.

Every single one of our lines of business that is supported has its own unique model. Right? Specifically, using AI to target, I need to get workers’ comp information out of these documents.

And that’s what you see shown in our in our experience.

We can see how this looks. We’re pulling all the information. We can validate it, all the information as well across each document. As we click into the information, it takes us right to the page where we’re looking for this detail.

Right? As I navigate, it’s gonna take me through the actual document and move me forward in the pages. So I don’t have to sit here clicking through and reading a thirty five page document. I can just let our AI take you where you need to go and show you all this extracted data.

Now AIs were really good. Right? We’ve talked about the workflows. We talked about the data extraction.

Let’s talk about comparison. Right? And this is where we have human in the loop as part of our process now today.

I had seen some discrepancies previously when I looked at my summary. Now I wanna do some additional review. So by doing that, I can quickly take a quick scan of the information I’m seeing here and say, hey. Thanks for flagging these that we’ve got a few discrepancies potentially.

But if I take a look, I can dig into the details really clearly and see maybe we’ve got some formatting issues because we have different documents. We’re gonna flag any discrepancy we think we might find because that’s gonna be something that’s important to be looked at. Make sure, hey. Is this something that needs to get signed off on?

We’re gonna present that to you if we think there is a potential discrepancy and allow our human, users to make the ultimate decision these things.

See, I’ve got not a not a whole lot of information that’s, you know, discrepancies here on this specific example, but I do have a few that I’m just gonna leave alone.

If I get into my exposures, that’s where things get a little bit more detailed because I have, you know, payroll. I’ve got rating factors, different things. What this is telling me as I’m looking at this is some things change year to year, but I’m not seeing too much. Right?

I’ve got all the class codes. I’ve got all the all of that information lined up. I’m just gonna leave these alone so when we get into an export, we wanna review a full dataset or detailed checklist. We can see those discrepancies clearly.

So I’m gonna leave those alone.

Let’s go get into policy forms. Policy forms, we’ve gone in and extracted policy forms as well. So we’ve got form numbers. We’ll look at addition dates. We’ll also look at descriptions and wording. Got a couple that came in that, you know, our tool says, hey. We only take a look at this again.

Maybe some discrepancies here where we’re only looking at form numbers.

I can clearly make an informed decision and match those up. And at this point, I’m gone. I’m back to my summary. I’ve now cleared up all of those discrepancies that I found necessary.

I can look at the coverage information. I can look at our, policy forms where maybe I’d have discrepancies or new addition dates flagged. And now I can go ahead and export this. I can put this in different, formats.

Couple of those formats we have, got an Excel checklist, some more traditional checklist that an account manager would be used to seeing, give you a nice side by side comparison in an Excel file. It’s exactly what you see in our interface, just in a really concise Excel file. If you’ve got a team that says, hey. We want all that policy data now.

Let’s get that data. We can give you that as a CSV output as well. You’ll soon to be JSON outputs, different data file formats that can be provided if you’re looking to take the data and push it into, data lake or other solution, that you maybe wanna use structured data for as well. But if everything’s looking good to you, you maybe take an action, you export your checklist, that’s just gonna natively pop out of your browser, and you can take it and do whatever you need to do with it downstream.

If you’re happy and you’re feeling good about your policy check, you just mark this as complete. You’re gonna get taken right back to your customer, and you’ve got a completed policy check. This information is gonna be available for you. You can come back at any point, access it, view it, reexport if you wanna pull another, checklist file or CSV file down as well.

Same thing, cool compare workflow.

A lot of the same technology is using the exact same way you saw us review from a policy checking standpoint. Little bit different workflow experience. We focus on a few different other things. But, again, you notice I get brought right to my summary view. I can see very clearly where I’ve got some premium discrepancies, from a quote standpoint. Right? Little different workflow, little different solution because instead of looking for E&O discrepancies like we do in policy checking, we’re hyper focused on finding the best quote or finding the best option for our insured or our prospect.

So in this case, we’re gonna first really hyper focus in on premium. We’re gonna allow you to take a look and see coverage discrepancies as well, across multiple quotes. Still be able to look at different exposures that are factored in. And then our forms works a little bit different than it does.

On the policy checking side, we get hyper focused here to break out exclusions, what’s not being offered by certain carriers and what is. So first, we’ll show you all the exclusions. In this case, I can see, hey. I’ve got, multiple exclusions on each option, but a little bit longer exclusion list on my right, quote here.

I also have my policy forms and endorsements. Those are all gonna be triggered and shown for you same way as well. And then the navigation, right, that workflow mentioned, we can go look at the actual data itself and see where it was extracted, be able to validate, did Patra’s model get this information right, that is all here for you to do if you wanna do any deeper dive reviews of our solution as well and be able to actually see the data, find where it was extracted within our policy document, as well.

Same view, multiple quotes, form compare. Right? Here’s our extraction, happening in real time. You get to your summary. And, again, our export options, if you want the data, you can certainly go ahead and take that data. If you’d like a checklist because you wanna see Excel side by side comparisons, you can take those checklists down, and you can go ahead and export those, and start to work on whichever of your quote may be the best option for your insured.

Okay.

That’s our demo for today. We obviously can do deeper dives if, folks wanna talk to us one. We’re happy to show off our technology here today. And, again, this is real benefit.

This is available today. This is live AI based solutions in production that allow users to navigate some of these complex document heavy workflows that traditionally have taken an hour, maybe multiple hours in some cases. Let’s get this done in five, ten minutes. Right?

We just did a policy check and a quote compare like that in ten minutes. Pretty exciting.

Alright, Brett. Thank you so much. Really appreciate that.

I apologize here. We kind of there we go. We kind of got out of whack there.

Hopefully, by watching that, you were able to see how our take on AI and technology has really created a very easy to use user friendly portal.

You’re able to get results quickly, comprehensively, get a beautiful output summary that’s actually actionable for you and your teams to work on.

So as we as we think through what we saw here and shared with you today, kind of leads us to our next steps.

And, well, hopefully, what we’ve prompted for you for the next step is you wanna get your own Iron Man suit. And in order for you to do that, we’ve got some QR codes. We’ll be sharing this information with you afterwards as well, so you’ll have these. Feel free to and we invite you to click on the QR codes or scan the QR codes, start a free trial with us. We have a no obligation, no commitment free trial. It’s a great way for you and your teams to get access to our technology in a real world use case, run some of your policies and your information through the platforms, see what the output looks like.

Again, the response that we’re getting from our current users today has been overwhelmingly, you know, a lot of folks are finding the value in here very quickly.

We think that you’ll be able to do the same. As Brett mentioned, we’ve got folks standing by ready to help you out. We can give you full demos. We could do demos for a larger team for you as well. If you do take advantage of the free trial, we’re always going to schedule an onboarding call with the end users themselves.

We’re gonna show them the portal, how to get started, run the policies through, how to get that output, and etcetera. So we are here for you. We really are looking forward to some of you folks taking advantage of this, the cost effectiveness, right, the efficiencies that are available for you.

So with that, I wanna thank you all for your time again. I know there’s a busy days for all of us these days. You had a lot of other ways to spend the last forty five minutes or so with us. We certainly appreciate you doing that with us here at Patra. I know there was a lot of questions submitted in the Q&A during the presentation.

Because of the large audience that we have and the number of questions, weren’t gonna answer those individually, But in our follow ups, we will certainly get answers to each and every one of those questions that everyone submitted. We do appreciate you submitting those questions, and we look forward to talking to all of you in the future. Thanks again for your time. We appreciate it.

Thank you, everyone.

The insurance industry is rapidly embracing AI for insurance solutions that deliver immediate, measurable results. This comprehensive webinar moves beyond theoretical discussions to showcase proven AI technology implementations that insurance distributors are using to transform their operations today.

Retail agencies, brokers, wholesalers, and MGAs are leveraging advanced AI solutions to achieve unprecedented efficiency gains. The session explores three critical applications: Policy Data Extract AI for automated data processing, insurance policy checking that reduces review time by 75% while maintaining 99.5% accuracy, and insurance quote comparison systems that enable same-day responses versus the industry average of two-plus days.

Real-world case studies demonstrate how distributors have achieved remarkable outcomes, including 90% faster processing times, 99.9% accuracy rates, and cost savings measured in millions of dollars. Account managers are gaining an average of 12 hours weekly for client relationship building, while agencies report 30% increases in commercial lines close rates.

The webinar provides practical guidance on evaluating, selecting, and implementing AI solutions that align with specific business objectives. Attendees learn about workstream flexibility options, from AI-only implementations to full-service solutions, ensuring optimal fit for their operational needs.

Industry leaders share proven strategies for reducing E&O exposure, eliminating processing backlogs, and identifying previously missed premium opportunities. The session concludes with actionable next steps and a framework for immediate implementation, enabling participants to begin their AI transformation journey Monday morning with confidence and clear direction.

About Patra

Patra is a leading provider of technology-enabled insurance outsourcing services and AI-powered software solutions. Patra powers insurance processes by optimizing the application of people and technology, supporting insurance organizations as they sell, deliver, and manage policies and customers through our PatraOne platform. Patra’s global team of over 6,500 process executives in geopolitically stable and democratic countries that protect data allows agencies, MGAs, wholesalers, and carriers to capture the Patra Advantage – profitable growth and organizational value.